Markets closed firmer across the boards for the grains today despite the very weak outside markets.

Corn was up 10 to 12 cents a bushel, Beans where up 9-13 cents, KC wheat was up 31 cents, crush sunflowers where firmer by 20 cents to 65 cents a cwt, MPLS wheat was up 25, CBOT wheat was up 31, the US dollar was 700 points or so firmer with the June presently at 75.730, crude was off 2.50ish a barrel, and the equities where under pressure with the DOW down 140 points. Perhaps the fact that the outside closed well above their low’s was a win for the bulls?

Weather has been dry in the HRW areas of the US as well as part off Europe. This along with the wet weather preventing spring wheat planting really helped wheat lead the way today despite the very weak outside markets. The thing I didn’t really understand is that most of the news for wheat is what we have been talking about the last week or so; while last week the market didn’t seem to care. I guess that is why the market is the market; perhaps it was simply the fact that we didn’t quiet see as much moisture as we thought we could in some places of KS? But I really thought the weather deal was old news; so even though I agree that we should see some sort of premium built into the wheat because of it I don’t understand why it happened when it did. Perhaps we just had to have a head fake and get more weak longs out?

Last week much of the pressure for the grains seems to steam from funds getting out of commodities across the board. I would think that pressure resurfaces if we see many more days of the outside markets getting beat up.

Export inspections where out this a.m. and they where good for wheat, ok to poor for corn, and ok for beans. Nothing to really write home about as no real surprises although it was good to see wheat come in above what is needed on a per week basis to meet current USDA projections.

This afternoon we had a crop progress report that showed corn 7 % planted versus 8 % on average. This was inline with the pre-report estimates I have been hearing.

Below is a link for more information on the crop progress.

We did add another new crop Act of God Sunflower contract today; the price is a little better then it has been; the contract is a High Oleic contract; please give us a call for more information.

Wheat basis is very hit and miss on spring wheat; while winter wheat feels steady to better. I did offer plenty of winter wheat trains out today; with little to no response; but my offers where on the high side and just the fact buyers where looking on a day when the board was up 30 cents has to be somewhat encouraging.

Keep in mind that wheat fundamentally might look bullish because of the weather as does corn look fundamentally friendly because of the lack of planting, tight old crop stocks, and acres needed; that history has shown us many times in the past when everything has seemed to be bullish and then just months later everything is bearish with the sky falling. Remember the last time we seen corn at these type of levels; June-July 2008; where did Dec corn get to in Dec of 2008; under 3.00 a bushel.

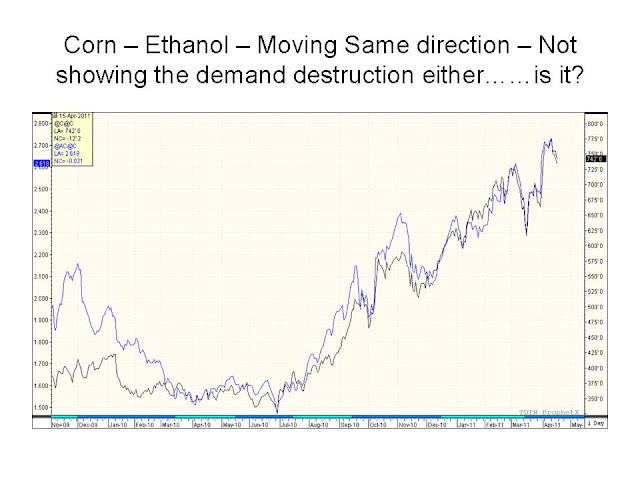

Things change in a hurry in our markets and the price action we have seen should show us or at least put in the back of our mind that the biggest fundamental is money flow. At any time on any day we are subject to see money simply flow out and not just for a day. I say this not to scare one into selling or not selling; but to remind one to use good risk management that has a back ground of not going broke via making profitable sales.

Please give us a call if there is anything we can do for you.