Various Trade Thoughts and Ideas - Not reccomendations; but thougths and ideas on various possible moves and concepts.

Here is a bullish corn trade from 12-21-10

Bullish re-ownership

For about even money sell a July 5.50 put to buy 2 6.10-6.70 July bull call spreads

Risk is unlimited on downside; upside max is $7000 per trade;

Presently July at 6.13; at expiration trade unlimited downside starts at 5.50; = long board; 5.50-6.10 = no position; 6.10-6.70 long from 6.10 on 2 contracts; higher then 6.70 = max

Below is a trade thought from 12-16-10

a different type of trade

Sell an in the money call, buy 2 at the money calls and sell 2 out of the money calls

on the idea below we used a 5.40 short july call and 2 long 5.90-6.60 bull call spreads......for a net credit of 45 cents........what the trade does for a producer is gives you a max 45 cents protection starting at 5.85

if we go up the max you can collect happens at 6.60 and that gives you 65 cents.....and in exchange for all of this you create an ending result that leaves you short at 6.60 when the June options expire; but you then keep keep the premium and end up netting 7.05.......the 6.60 call option plus the 45 cents you collected on the trade

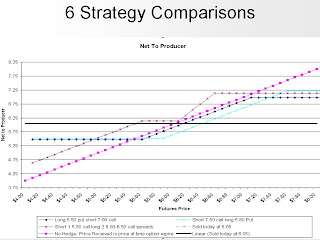

Below is a table that shows from a producer perspective; bottom line is that versus selling today one puts them self in a position to have a little protection but also add a little if we move up. If we stay between 5.40 and 5.90 one will be short at 5.40....between 5.90-6.60 one will be long 1 contract at experation from 5.90.....and if we go above 6.60 one will be short at 6.60........net you create a window that helps get most producers exactly what they want (if we stay within a range) in that one has some protection but also can make money on the upside.......that is what everyone is looking for........correct? trades that pay you wether we go up or down.........

The best thing from a producer standpoint is that at expiration a producer net's 7.25 if we are anyplace above 6.60........which is great with corn in the 6.00 ish area......not so great if we get there and corn is trading higher........and there in lies the one spot of big risk in this trade........on the downside.........you simply don't get enough protection on a break below 5.40...........but would you own corn that today is near 6.00 at 5.40???

the other way of looking at this trade is simliar to a stock replacement strategy; in that you own corn at on a break at 5.40......own corn at the money for up to 70 cents....and if we end up at 7.25 or higher the most you can get is 7.25

| BOARD EXPIRE | Trade P L | Net Futures Producer Receives |

| $ 5.00 | $ 0.45 | $ 5.45 |

| $ 5.10 | $ 0.45 | $ 5.55 |

| $ 5.20 | $ 0.45 | $ 5.65 |

| $ 5.30 | $ 0.45 | $ 5.75 |

| $ 5.40 | $ 0.45 | $ 5.85 |

| $ 5.50 | $ 0.35 | $ 5.85 |

| $ 5.60 | $ 0.25 | $ 5.85 |

| $ 5.70 | $ 0.15 | $ 5.85 |

| $ 5.80 | $ 0.05 | $ 5.85 |

| $ 5.90 | $ (0.05) | $ 5.85 |

| $ 6.00 | $ 0.05 | $ 6.05 |

| $ 6.10 | $ 0.15 | $ 6.25 |

| $ 6.20 | $ 0.25 | $ 6.45 |

| $ 6.30 | $ 0.35 | $ 6.65 |

| $ 6.40 | $ 0.45 | $ 6.85 |

| $ 6.50 | $ 0.55 | $ 7.05 |

| $ 6.60 | $ 0.65 | $ 7.25 |

| $ 6.70 | $ 0.55 | $ 7.25 |

| $ 6.80 | $ 0.45 | $ 7.25 |

| $ 6.90 | $ 0.35 | $ 7.25 |

| $ 7.00 | $ 0.25 | $ 7.25 |

| $ 7.10 | $ 0.15 | $ 7.25 |

| $ 7.20 | $ 0.05 | $ 7.25 |

| $ 7.30 | $ (0.05) | $ 7.25 |

| $ 7.40 | $ (0.15) | $ 7.25 |

| $ 7.50 | $ (0.25) | $ 7.25 |

| $ 7.60 | $ (0.35) | $ 7.25 |

| $ 7.70 | $ (0.45) | $ 7.25 |

| $ 7.80 | $ (0.55) | $ 7.25 |

| $ 7.90 | $ (0.65) | $ 7.25 |

| $ 8.00 | $ (0.75) | $ 7.25 |

No comments:

Post a Comment