Below are various charts on Corn, KC wheat, MPLS Wheat, CBOT Wheat, Soybeans, Crude Oil, Equity Marktets, and the US Dollar Index

To start with however is an option trade for producers to look at for hedging new crop corn; I like this strategy over nearly all other basic hedge strategies because it out performs nearly all of them over a wide range of prices. It doesn't out perform all strategies on big breaks or big advances.

The strategy is selling an in the money call option, buying two more call options that are at the money and then selling 2 more call options out of the money. I don't think this trade can be done with the same type of P L Graph with fewer trades but if it could then fewer traders would obvisouly be better.

The above trades used DEC Corn; done with option closing prices April 15th

Sold 1) 6.10 Call

Purchase 2) 6.60 calls

Sold 2) 7.20 Calls

Trade not bad as spec move as it can win if prices go up, prices go down, or even if prices go side ways, but won’t be a winner in big up market; breakeven or unlimited losses start at $7.83 on the Dec contract which closed at $6.56 per bushel

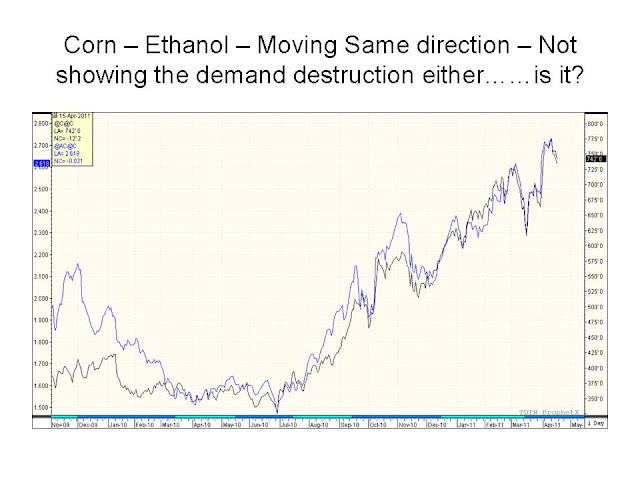

Here are the Charts

No comments:

Post a Comment