Information about grain markets and info to help producers to market crops. See how various grain marketing strategies can effect ones average price. We will be posting various potential trade and option strategies along with marketing decisions made on our mock farms. Now helping daily market minute in empowering farmers to fight big ag and become price makers. Education to help farmers manage crop risk such as corn, soybean, and wheat prices. Using futures, options, basis contracts etc.

Sunday, March 31, 2013

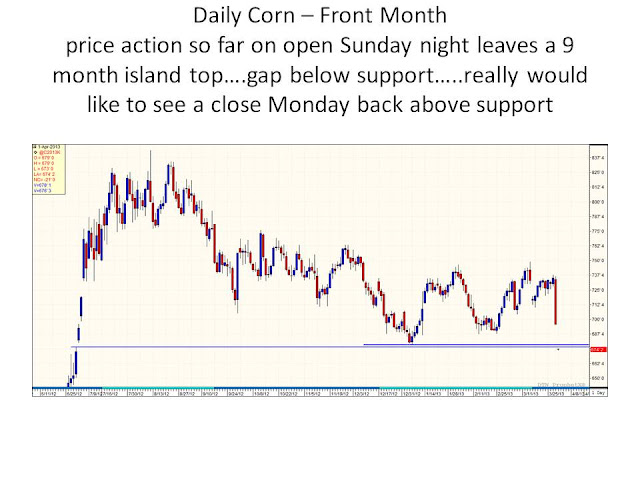

USDA Report Game Changer - Sticker Shock

Last week Thursday the USDA threw a big curve ball for all of the bulls out there. With March 1 stock numbers well above trade estimates for both corn and soybeans. I am sure everyone has seen the numbers so I won't dwell on that.

Rather what does it mean for prices going forward and what are some possible theories on the USDA logic? First off prices going forward should stay under pressure or really show us the small crop long trail theory. Most balance sheet estimates that I have seen for corn are now between 800-1.0 billion bushels. After all the USDA found nearly 400 million bushels more in the stocks then the trade estimates. Before this last report the old crop corn carryout was pegged at 632 million bushels and if most of the estimates had that pegged as an ending carryout number or close to that as an ending carryout number then now naturally some estimates might be up to the billion bushel mark.

Is it possible that the USDA doesn't increase our carryout by the trade estimate miss.........yes and history has shown us where the USDA sometimes has some logic; but typically this has been on the September stocks report and the logic was the use of new crop harvested bushels.

First logical thing that comes to mind is that the USDA just under estimated the crop size. But here is a long shot for the bulls out there. Keep in mind that even though our number this last week was 400 million bushels above estimates it was also 600 million bushels below last year. What happened in last year's 3rd and 4th quarter for usage? It wasn't exactly helped out by the strong basis and then it wasn't helped out further by the run up to nearly 8.50 either.

Was there end users that last year in June-August that shut down and really didn't start up because of the drought? Ethanol or feed guys that couldn't make it work with the negative margins and strong basis that got handed a drought card on top of it that really slowed down usage and allowed us to keep a carryout near a billion bushels?

What could be different about this year or what could be a reason for the USDA not to be nearly as aggressive on carryout cuts as most area already pricing in? First off perhaps some of the demand that we curbed 8-12 months ago was the weak demand; perhaps that guys left out there buying are strong hands? Secondly as it stands today we have more demand coming back in via a bigger crop then last year's drought yield shorten crop.

So now we have a stage that we have a major price break on old crop and ideas of a huge new crop supply. If end users can buy old crop profitably and new crop with even more profits what have we done for our demand? In theory we haven't hurt it and perhaps just perhaps we have stages set that tell every end user out there to hang on. If that is the case is it possible that the USDA doesn't increase our carryout nearly as much as estimates have???

Bottom line is the stocks number was a major surprise to the trade but would it have been a surprise to the USDA? That my friends we really don't know.

We do know that if the carryout numbers increase like the trade has estimated that longer term we now have to find a lot of demand especially given the planting intentions. Last year we had to curb more demand then ever; but it is now very possible that we will have to find more demand then ever; perhaps more then we even curbed.

I thought after the USDA's March Supply and Demand Crop Report that perhaps the reason the USDA increased feed/residual demand was the fact that things are so tight that they couldn't afford a massive price drop that would increase any demand. That might also be another reason for us to not see the huge carryout numbers on the USDA's April Supply and Demand Crop Report despite the worst miss ever on the stock's report.

Overall don't take the above comments as super bullish; more balanced. As overall the headlines have turned negative and the most likely outcome isn't for a balance sheet to stay super tight; but rather a balance sheet that isn't nearly as tight as it has been. The above reasons or possible theories might be a reason to cover up short call options or holding a small amount of grain for the home run. But odd's for anything other then a balance sheet with a huge carryout increase are not good. Possible that the USDA has another theory; but nothing to exactly make a big wager on.

As for what to do as we go forward; first is to realize that if the report was really a game changer that most all rallies should be rewarded with some sales. Most will say that since September one should have been selling the rallies and looking back that is more then true; but that might also mean that could see a near term bottom sooner then later. This report basically has everyone bearish right now.

Last time corn seen a move like this was the June 2011 stocks report when the July contract which had no limits traded down 69 cents; very close to the type of move the synthetics indicated the move was on Thursday...........It's important to note that was the lows for that move. Does that mean that this thing could make it's lows Sunday night or Monday? No it doesn't mean it will shake out that way but it could.

Rather what does it mean for prices going forward and what are some possible theories on the USDA logic? First off prices going forward should stay under pressure or really show us the small crop long trail theory. Most balance sheet estimates that I have seen for corn are now between 800-1.0 billion bushels. After all the USDA found nearly 400 million bushels more in the stocks then the trade estimates. Before this last report the old crop corn carryout was pegged at 632 million bushels and if most of the estimates had that pegged as an ending carryout number or close to that as an ending carryout number then now naturally some estimates might be up to the billion bushel mark.

Is it possible that the USDA doesn't increase our carryout by the trade estimate miss.........yes and history has shown us where the USDA sometimes has some logic; but typically this has been on the September stocks report and the logic was the use of new crop harvested bushels.

First logical thing that comes to mind is that the USDA just under estimated the crop size. But here is a long shot for the bulls out there. Keep in mind that even though our number this last week was 400 million bushels above estimates it was also 600 million bushels below last year. What happened in last year's 3rd and 4th quarter for usage? It wasn't exactly helped out by the strong basis and then it wasn't helped out further by the run up to nearly 8.50 either.

Was there end users that last year in June-August that shut down and really didn't start up because of the drought? Ethanol or feed guys that couldn't make it work with the negative margins and strong basis that got handed a drought card on top of it that really slowed down usage and allowed us to keep a carryout near a billion bushels?

What could be different about this year or what could be a reason for the USDA not to be nearly as aggressive on carryout cuts as most area already pricing in? First off perhaps some of the demand that we curbed 8-12 months ago was the weak demand; perhaps that guys left out there buying are strong hands? Secondly as it stands today we have more demand coming back in via a bigger crop then last year's drought yield shorten crop.

So now we have a stage that we have a major price break on old crop and ideas of a huge new crop supply. If end users can buy old crop profitably and new crop with even more profits what have we done for our demand? In theory we haven't hurt it and perhaps just perhaps we have stages set that tell every end user out there to hang on. If that is the case is it possible that the USDA doesn't increase our carryout nearly as much as estimates have???

Bottom line is the stocks number was a major surprise to the trade but would it have been a surprise to the USDA? That my friends we really don't know.

We do know that if the carryout numbers increase like the trade has estimated that longer term we now have to find a lot of demand especially given the planting intentions. Last year we had to curb more demand then ever; but it is now very possible that we will have to find more demand then ever; perhaps more then we even curbed.

I thought after the USDA's March Supply and Demand Crop Report that perhaps the reason the USDA increased feed/residual demand was the fact that things are so tight that they couldn't afford a massive price drop that would increase any demand. That might also be another reason for us to not see the huge carryout numbers on the USDA's April Supply and Demand Crop Report despite the worst miss ever on the stock's report.

Overall don't take the above comments as super bullish; more balanced. As overall the headlines have turned negative and the most likely outcome isn't for a balance sheet to stay super tight; but rather a balance sheet that isn't nearly as tight as it has been. The above reasons or possible theories might be a reason to cover up short call options or holding a small amount of grain for the home run. But odd's for anything other then a balance sheet with a huge carryout increase are not good. Possible that the USDA has another theory; but nothing to exactly make a big wager on.

As for what to do as we go forward; first is to realize that if the report was really a game changer that most all rallies should be rewarded with some sales. Most will say that since September one should have been selling the rallies and looking back that is more then true; but that might also mean that could see a near term bottom sooner then later. This report basically has everyone bearish right now.

Last time corn seen a move like this was the June 2011 stocks report when the July contract which had no limits traded down 69 cents; very close to the type of move the synthetics indicated the move was on Thursday...........It's important to note that was the lows for that move. Does that mean that this thing could make it's lows Sunday night or Monday? No it doesn't mean it will shake out that way but it could.

Tuesday, March 26, 2013

Closing Comments 3-26-2013

Markets closed mixed today behind pre-report trading, firm

outside markets, and some weather concerns.

Corn was down 3 cents a bushel, soybeans were up 11 cents a

bushel, KC wheat was up a dime, MPLS wheat was up a nickel, CBOT wheat was up 4,

the equity market bounced with the DOW up 112 points (looks like the bull

market is back on), the US dollar was near unchanged with the cash US Dollar index

at 82.858, and crude was up 1.40 a barrel.

Not a bad day for the grains; with a lot of strength for

wheat seen in the finally 5-10 minutes of trading. Corn even though it didn’t manage to close

positive did close a nickel off of its lows; all in all not a bad day; but

technically a day that seemed to help markets consolidate ahead of a report. I view the consolidation happening at some

areas that should allow for a big move one way or another; i.e. right up near

resistance on the wheat/corn charts; so Thursday’s report will either help the

charts look like a clear breakout should the report be bullish or a nice head

fake or failure at resistance. It is

nice how charts and fundamentals seem to tie up together; it’s just too bad

that we don’t also have clear direction whether we will fail at resistance or break

threw and make another leg higher.

A couple news items out today besides the pre-report talk

included freeze talk with some possible damage done to some of the HRW wheat in

areas that have it jointing such as parts of OK; overall it doesn’t appear that

a lot of major damage was done; but it is one of those things that really might

not be known until the combines hit. Temps

are expected to warm up next week; but that doesn’t mean we won’t have another

freeze scare at some point in the future.

Talk that Egypt is very low on wheat inventory has also been

around; but it also sounds like they won’t be in the market buying for a couple

of months.

Basis is weaker or at least feels weaker for corn and winter

wheat. I had a train out today that was

bid 10 cents less then it was a weak ago despite very similar quality. Also still not finding much for corn bids and

the bids that I have seen are rather soft on basis.

The birdseed market felt a little better today with a little

more interest; but still overall on the slow side.

Report is out on Thursday; I will be out of the office the

next couple of days but Jordan, Dan, and Kevin or your local station managers

will be around if anyone is looking to take a little risk off the table ahead

of the report. My bias is a little

negative corn and friendly wheat; mainly because of the fact everyone seems to

be bullish corn and I think wheat has had decent demand as of late. I also think that perhaps we used a little

more wheat for feed and thus less corn; but I guess only time will tell.

After the report it really feels like old crop corn will go

to trading demand as will old crop soybeans.

Wheat should really become a weather market as should new crop

corn/beans. How important weather will

be will depend on how many acres we get; the more acres the less important

weather will be and vice versa. The

other thing we will need to watch will be money flow and the funds.

Please give us a call if there is anything we can do for

you.

Thanks

Afternoon Recap from CHS Hedging's Tregg Cronin 3-26-2013

Outside Markets as of 1:30: Dollar Index up 0.082 at 82.911;

NYMEX-WTI up $1.32 at $96.17; Brent Crude up $0.72 at $108.88; Heating Oil up

$0.0003 at $2.8775; Livestock were mixed with cattle down and hogs up; Gold

down $7.70 at $1596.80; Copper up $0.0090 at $3.4540; Silver down $0.095 at

$28.72; S&P’s up 8.00 at 1555.00, Dow futures are up 82.00 at 14,467.00 and

Treasuries are a tad firmer.

Shaky economic data today to bring the focus back on the US

instead of Cyprus and Europe. The headline number for Durable goods

orders was better than expected up 5.7% vs. the forecast of 3.9%, but much of

the gain was due to in large part to a 95.3% m/m rebound in commercial aircraft

orders, reversing a 24% slump in January. Ex transportation, durable

goods orders actually fell by 0.5% m/m. Consumer confidence dipped

sharply to 59.7 in march from 68.0, and could be a delayed reaction to the

rally in gasoline prices during most of the survey period. Gasoline

prices are on their way back down, however.

Grains

Mixed day with a nice rally at the close for beans and

wheat. Hard to separate pre-report positioning and genuine price action

given the proximity to the March reports. The features today were

definitely the cold weather overnight in the southern plains, chatter about

Brazilian soybean sales rolling back up to the US (limited), margin induced

corn selling and talk of more Argentine maize trading into the US-SE. I

sent around maps of the cold temps overnight as well as the progress of the HRW

crop earlier, so I will assume that subject has been well discussed.

Believe that is the cause behind the late rally led by HRW. Still very

split opinions out there on what amount of damage the cold is actually doing at

this juncture.

Chatter this morning about some limited soybean business

rolling back up to the US this week. Given the fact the vessel lineups

keep building in Brazil (see below), not too surprising. Argentina has

cheaper beans than the US, but Argentina is only 5-10% harvested and won’t have

supplies in a shippable position until mid-April. At 223 vessels and

13.169MMT, lineups are still easily an all-time record. Caution thinking

basis is going to get supercharged at the PNW and Gulf, however, as exporters

are only going to pay what is absolutely necessary to get the current boat

covered. Few are willing to be short a ton of bean basis given the well

discussed supply tightness in both the upper-Midwest and corn belt.

Either way, will put Thursday’s March 1 Stocks even more in focus. The SK/SN

price action certainly fits with more business being done as it rallied 1.50c

to +21.25c today on good volume.

I sent around the margin increase information earlier this

morning. Margins were increased for new crop corn, new crop corn spreads

and old/new crop spreads. Could be part of the reason for the July led

pressure this week as well as the CN/CZ correction we’ve seen. In

addition, plenty more chatter in the trade about Argentina approving additional

export licenses on corn following the 2MMT of licenses approved last

week. A couple implications: 1) likely have more confidence their corn

crop is above 25MMT. 2) raises odds for more Argy maize to trade into the

US. There was talk a handymax or panamax vessel, 40-60,000MT, traded into

US-SE last week. Talk of more trading in today. Argy FOB basis

levels are said to be around -45/-50K for May delivery which is a $269/MT FOB

price. Using panamax freight of $27/MT or handymax freight of $36/MT,

would lay into Brunswick/Wilmington/Mobile somewhere between $296-$305/MT

C&F. This would be somewhere around +21/44K vs. US-CIF bids at

+52/56K for May. Despite this, CK/CN rallied +0.75c to +18.75c which

certainly runs contrary to the aforementioned. Tonnages may not be enough

at this point to tank the US market, but should mean our export business

remains subdued at the very least. Cheap barge freight and May close to

delivery equivalence is probably limiting the amount of imports some are

willing to extend at this point.

And while somewhat of a tangent, worth noting the chart

below which shows the aggregate gross commercial long position (end users) of

Live Cattle, Feeder Cattle and Lean Hogs which is at a new all-time record high

going back to 1/3/2006. Compare this with the aggregate net spec position

which is near the lowest levels since October 2009. While specs have been

right up this point, the people who actually use the meat are toting record

long positions while the people who buy and sell paper are net short this

market. Anytime you get such a sharp divergence between these two groups,

I think bears watching.

Brazil Daily Soy Shipments From Major Ports: Summary

(Table)

2013-03-26 17:36:03.38 GMT

By Daniel Grillo

March 26 (Bloomberg) --

Following is a table detailing scheduled soybean

shipments for vessels berthed, arrived or expected at

major ports in Brazil,

according to SA Commodities in Santos, Brazil:

*T

=============================================================================

March 26 March

25 March 22 March 21 March 20 March 19

2013 2013

2013 2013

2013 2013

=============================================================================

-------------------------# of Ships------------------------

Soy

total

223 209

212 207

206 201

Soybeans

175 167

171 165

165 165

Soy

meal pellets

32

29

29

28 28

27

Soybean

meal

16

13

12

14

13 9

Soybean

oil

0

0 0

0

0 0

---------------------Metric Tons (000’s)-------------------

Soybeans

10,699.9 10,194.3 10,421.3 10,071.4 10,025.2

10,042.8

Soy

meal pellets 17,184.6 15,729.6 15,729.6 15,329.6

15,329.6 14,869.6

Soybean

meal

750.7 644.9

559.5 782.6

722.6 500.7

=============================================================================

March 26 March 25 March 22

March 21 March 20 March 19

2013 2013

2013 2013

2013 2013

=============================================================================

Soybean

oil

0.0 0.0

0.0 0.0

0.0 0.0

Oklahoma

Freeze Threatening Crop Damage to Wheat Hurt by Drought

2013-03-26

15:10:55.920 GMT

By Tony C. Dreibus

March 26 (Bloomberg) -- Freezing

weather in Oklahoma may

have damaged wheat plants that already were hurt by the

worst

drought since the 1930s.

Temperatures overnight dropped

to 15 degrees Fahrenheit

(minus 9 Celsius) near Guymon, in the Oklahoma panhandle,

National Weather Service data show. The freeze may have

hurt

wheat tillers, which are stems that emerge from the root

of the

plant and produce grain, Telvent DTN said in a report.

Plants were susceptible to

damage because there was little

or no snow cover to protect against freezing weather,

said

Darrell Holaday, the president of Advanced Market

Concepts.

“They had moisture a month ago,

but the last two or three

weeks, it’s been dry,” Holaday said by telephone from

Wamego,

Kansas. “And their crops were further along. I think you

probably had some damage.”

Growers of hard-red winter

wheat, used to make bread and

grown mostly in the southern Great Plains, may leave

almost 24

percent of their crop unharvested this year because of

the

drought, Futures International LLC said in an e-mail

yesterday.

Farmers seeded 29.1 million acres with hard-red winter

varieties

from September through November, Department of

Agriculture data

show. Oklahoma is the second-biggest grower behind

Kansas.

About 26 percent of the crop in

Oklahoma was in good or

excellent condition as of March 24, up from 24 percent a

week

earlier, according to the USDA. In Kansas, 29 percent of

plants

earned top ratings, unchanged from a week earlier, the

government said in a report yesterday.

Sequestration

begins to Bite US Agriculture

2013-03-26

14:28:23.86 GMT

The $85 billion in federal budget cuts to federal

spending that began on March

1, 2013, better known as the sequester, promises to reach

broadly and deeply

into agriculture spending, all the way to the cotton

farm. After already

announcing plans to suspend several reports due to

sequestration cuts, the USDA

is going one step further, announcing a series of steep

cuts in direct payments

to US farmers across a range of commodities. The

USDA Farm Service Agency (FSA)

recently notified Congress of its intention to capture

the required sequester

savings by reducing payments made through the direct

payment program account by

up to 8.5%. The agency said the exact final

percentage reduction in direct

payments won't be known until closer to the end of the

current fiscal year on

Sept. 30th, since direct payments are to be made in

October. Already, groups

representing US cotton, rice, and wheat producers have

been notified of the

looming cuts. The Department advised Congress of

the plan and will wait 30 days

(until April 20) before implementing the reductions.

Tregg Cronin

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

CHS Hedging, Inc.

The Right Decisions for the Right Reasons

The Right Decisions for the Right Reasons

Overnight Highlights from CHS Hedging's Tregg Cronin 3-26-2013

Outside Markets: Dollar Index up

0.0780 at 82.908; NYMEX-WTI up 0.48 at $95.29; Brent Crude down $0.12 at

$108.05; Heating Oil down $0.0032 at $2.8740; Livestock markets are

mixed/better led by hogs; Softs are rallying this morning; Gold is down $6.70

at $1597.70; Copper up $0.0135 at $3.4585; Silver down $0.060 at $28.755;

S&P’s are up 2.00 at 1549.00, Dow futures are up 17.00 at 14,403.00 and

Treasuries are weaker.

A relative calm over the financial

world this morning as investors continue to digest the recent Cyprus bailout

and the implications it could have for Italy, Spain and Portugal. An

executive board member on the European Central Bank said overnight the ECB will

do everything it can to preserve the common currency which is giving support to

the euro. The EURUSD is +0.155% and the EURJPY is up +0.412%. A

fair amount of economic data this morning with durable goods forecast up

3.9%. The S&P/Cash Shiller 20 City housing index for January is

forecast up 0.75%. Consumer Confidence for March is seen at 67.2, down

from 69.6 in February. New home sales are forecast at 420,000, down 3.9%

from last month. Argentine 5-yr Credit Default Swaps are up 437.22bp

to 3,634bp this morning.

A little additional moisture in

the last 24 hours, but mostly east of the MS-River. Dry everywhere west

of there. Light snow falling in the east this morning. Dry in the

Midwest until Friday at which time another 0.10-0.50” is forecast in

AR/MO/SE-KS/OK. This starts the system, and then Friday through Sunday

brings a total of 0.50-1.75” to the same border area of the aforementioned

states. Early next week sees more moisture fall west of that area

covering more of N-TX and OK. KS should see a general 0.25” of water

moisture. Northern Plains is mainly dry. Wet and cold persists in

the 6-10 and 8-14 according to NOAA last night. The above normal precip

is mainly focused in the mid-south and south. Little snowpack melt seen

for MN/ND/SD.

***Note Attachment from the CME Group related to margin

changes***

Despite the CME Group raising margins on swaps, new crop

corn futures and old/new spreads, margin induced selling pressure didn’t take

hold last night and markets chopped inside very tight ranges. As of

this writing, the corn overnight range is 2.5c, beans is 6c and wheat at

4c. This shouldn’t surprise given one of the four biggest USDA reports of

the year is two days away. As noted yesterday, don’t try and read too

much into the pre-report chop. More chatter about spring planting and the

acreage pie overnight, but nothing substantive. Cash markets were quiet

yesterday, mostly unchanged from Friday although corn looked a tad

firmer. Row crop spreads remain in general uptrends. We should all

go home and come back Thursday at 11:00…

Overnight news was sparse. Reuters carried articles

about Egypt’s dire wheat stock piles and their inability to source additional

supplies. Due to the economic and political turmoil of the last two

years, Egypt’s hard currency reserves have eroded by about $1 billion a month,

raising questions about its ability to pay cash at open tenders. Sources

say they have enough wheat to get to new crop in June, but Egypt will remain

the largest wheat importer in the world with the inability to pay. NASS

released updated wheat condition ratings with KS and TX showing slight declines

while OK improved. KS saw its G/E unchanged at 29%, but it’s weighted

index declined from 292 to 284. See table below. There were

articles out overnight also talking about the level of abandonment rising to

>20% this year. This has been talked about in the trade before, but

few have probably thought about the full implications. Also below is a

table showing southern corn planting progress. As one can see, three of

the four states are ahead of the 5-yr average for this week.

Other articles included IMEA reducing its forecast for Mato

Grosso soybean production to 23.6MMT from 24.1MMT due to the dry spell earlier

this year. The state’s harvest is estimated at 92.6% vs. 85.2% a week ago

and 94.4% a year ago. China’s state owned researcher Grain.Gov.Cn said

China’s major ports had 1.25MMT of palm oil stocks, down 30,000MT from a week

earlier, but up from 850,000MT a year ago. Inventories remain high,

pressuring crush margins. South Korea’s NOFI is tendering to buy 140,000MT of

corn for August delivery and 70,000MT of wheat for August 25th.

United Arab Emirates purchased 40,000MT of corn from South America.

Open interest changes yesterday included wheat up 860

contracts, corn up 1,670, beans down 1,120, meal up 730 and soyoil down

500. The string of huge open interest increases in corn looks like it is

finally over, but over 100,000 contracts has been added since March 1, at the

same time as funds were adding close to 100,000 contracts of net length over

the same time. Chinese markets were quiet with beans unchanged, meal up

$1.60, oil down 15c, corn down 0.75c, palm down 51c and wheat down 2.25c.

Paris Milling Wheat is up 0.31%, Rapeseed up 0.42%, UK feed wheat up 0.30%,

Corn up 0.44% and Canola is up 0.65%.

Call things mixed to get started, but it might be worth

noting how the pit likes the margin increases at 9:30. Locals are the

ones really affected by margin changes. Otherwise expect more chop and

slop ahead of Thursday with no major reports or data sets due out until

tomorrow. Corn is holding recent gains well, but the strength has been

mainly about specs adding length while the farmer sold physical. End

users seem well supplied unless the perception about stocks changes Thursday.

Tregg Cronin

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

CHS Hedging, Inc.

The Right Decisions for the Right Reasons

The Right Decisions for the Right Reasons

Monday, March 25, 2013

Closing Comments 3-25-2013 - USDA Report Preview

Mixed day for the grain markets today.

Corn closed up 7 with much of that strength coming from fund

buying near the close, soybeans closed down 3, KC wheat was down 3, MPLS wheat

was down 1, CBOT wheat was down 3, equities closed weaker with the DOW off 64

points, crude was up about a buck, and the US dollar was sharply higher.

An ok day for the grains; but one that also left me feeling

a little cautious. First off the strong

close by corn seemed to come from the funds and idea’s that this week’s report

will be bullish. The only bearish

forecasts I have seen for the report are those worried about the fact that

everyone seems to be bullish on it and I land in that camp. That we have had a nice rally since the last USDA

report; but we also seem to have too many looking for bullish numbers which opens

the door will they be bullish enough.

What if they are not bullish but actually bearish. No one is talking about it; but this report doesn’t

have a history of always limit up; there have been numerous times when it has

been limit down. I do feel that the report

happening when the markets are open will take a little of the extreme out of

the report; but also add to the volatility.

What I mean by the extreme out of the report is the fact

that we won’t have everyone waiting for the open to and getting more bulled up

or bearish. I guess I have a theory that

the longer the info is out without pricing itself into the market the more

extreme the movement when the market opens.

I.E. in the past the markets had always been closed when the USDA

released it’s stocks or S & D reports.

The past few the market has been open and the market seems to trade both

sides in rather choppy volatile trading action when the report is

released. Before if we had a bullish

report; we wouldn’t see the market trade both sides; it would simply trade

higher off of the open or lower off of the open if we had a bearish

report. Before by the time we had the

report out everyone had already jumped on the buy or sell bandwagon; now with

the markets open the price discovery happens for a little longer period of time

in my opinion.

Back to my point; it just feels to me that we have some risk

on old crop corn in particular that everyone is looking for a bullish

report. It might take something super

bullish to have follow through buying.

Also a little concerning is the local fact that I can’t find much if any

homes for nearby corn. End users completely

plugged and having no interest for a few months is not bullish; but that might

just be a local thing as some areas still need corn hence we still have a

decent inverse on the board.

The other thing that made me a little nervous today was the

price action on the outside markets. A

very strong US dollar doesn’t help us get additional exports and an overall

risk off type of attitude won’t promote money flowing into investments such as

commodities. I didn’t like the DOW price

action today; perhaps it was just another small correction in what has been a

big bull market since 2009; but trades like today were we put in new all time

highs and trade lower than the previous day’s lows are yellow flags to me and

technically made give some a decent risk reward spot to go short. Plus we have all seen the arguments on the

actually strength of our economy; so I won’t go down that road; but some of the

things going on in Europe and with Cyprus should make us nervous. That isn’t all bad either because it means

that at least some are playing the market from the short side which means we

have a little balance. When everyone

gets supper bullish or supper bearish and we don’t have that balance that is

when typical blow off tops or bottoms tend to be made.

Else were today basis felt a little weaker for corn. As mentioned above a lack of homes; or at

least homes at values that are being posted.

There is always a price that will trigger buyers; but right now that

price is much lower than most of the posted bids. The positive for corn is that most end users

especially in our area have little to zero coverage for

June-July-August-September corn and I know of a couple plants that use 4-5

million bushels a month. That’s a lot of

corn that they need to buy at some point?

Wheat basis felt a little weaker today as well; seen a small

increase in producer selling with some moisture hitting parts of the southern

growing regions. (Heard of a foot in

parts of Kansas for snow in the last event.)

We also still really lack hard red winter exports; we haven’t had any of

the wheat in our area go to the export market.

While years of some bull markets we seen wheat in our area go that

direction. Right now those markets are

still 30 cents or so away from our domestic market for winter wheat. Spring wheat is close; but part of that is

due to the fact that spring wheat in our area can trade a small discount to the

ND spring wheat due to quality and spreads going west.

The sunflower market is slow; bids and offers seem to be

getting a little wider. But orders have

been decent and the crush is competitive with the birdseed.

Seen a rumor that some more Argentina corn has been booked

into SE US Feeder markets. That would be

a both bullish and bearish thing. Shows

us how expensive our corn is versus some other places in the world; but also

friendly because we don’t have enough corn to meet our demand.

We did get some cars into most of our locations over the

weekend and we are offering free delayed price on most of the grains. With the cars most of our locations have room

for almost any grain………….call if you have questions.

Thanks

Friday, March 22, 2013

Overnight Highlights from CHS Hedging's Tregg Cronin 3-22-2013

Outside Markets: Dollar Index

down 0.146 at 82.593; NYMEX-WTI up $0.45 at $92.91; Brent Crude up $0.10 at

$107.57; Heating Oil down $0.0034 at $2.8929; Livestock markets are

mixed/weaker; Gold down $6.20 at $1607.60; Copper up $0.0280 at $3.4630;

S&P’s are up 3.25 at 1542.25, Dow futures are up 33.00 at 14,381.00 and

Treasuries are firmer.

Despite the latest spate of

headlines from Europe, global financial markets actually exhibiting a fair

amount of calm and order. While the NIKKEI fell 2.35% overnight, Europe

is flat this morning and the FTSE MIB is actually up 0.35%. Bond yields

across Europe are easier this morning, and the Euro is rallying against all of

its major trading partners. The EURUSD +0.462%, EURJPY +0.266% and EURGBP

+0.299%. The latest headlines in the Cyprus Crisis is European officials

rejecting an alternative plan from the Cyprus gov to save its banking sector

and remain in the Eurozone. Cyprus needs to raise €5.8 billion to avert

crisis and secure bailout financing by Monday. Expect a weekend chocked

full of headlines heading into the Monday deadline. No economic data

today.

The last 24 hours saw precip in

AR/S-MO, and some snow fell in NE/SD with more still falling this

morning. More precip will move into towards the weekend for the

southern plains with all of KS expected to see 0.50-0.60” Sat/Sun. This

will push into MO as well where amounts will be slightly heavier. OK sees

moisture as well. This system moves into IL/IN/KY/OH by Monday with S-IL

seeing as much as 0.94”. Following Sunday’s system, the Midwest will be

quiet Monday through Friday. NOAA’s maps continue to point cold and dry

in the 6-10 with a slight moderation in the temps for the 8-14, but still

fairly dry in that period. Most of the WCB remains in some stage of

drought and could use additional moisture as opposed to getting in the field

early.

Slightly easier markets overnight as we consolidate recent

gains in both grains and the sharp rally in oilseeds yesterday afternoon.

Unfortunately, there is no chatter on the wires this morning as to the reason

behind the soybean rally yesterday. Most traders will be watching the

USDA website at 8:00am this morning to see if there were any sales reported to

Washington. The rally was back end led, but CIF traders noted as much

as 770,000 bushels of new crop beans changing hands yesterday. Between

the logistical backups in Brazil, and the inability to source Argentine

supplies until at least April (let alone their labor issues), it is possible we

did some more old crop soybean business. Corn and wheat seem to be

running into soft cash markets following a solid week of movement by farmers.

Bloomberg released several polls ahead of next week’s USDA

reports. Rather than rehash them here, I’ve included them below.

Only blatant observations would be slightly lower corn acreage estimates, slightly

higher soybean acreage and the trade clearly anticipating a bullish Mar 1

Stocks number. With an average trade estimate below 5.00bbu, the trade is

basically assuming Q2 corn feed demand didn’t slow to the level the USDA is

currently implying. Just looking at estimates, would appear 5.0-5.1bbu is

the range: above 5.1bbu is bearish and below 5.0bbu is bullish. News out

of China overnight said March soybean imports may be 4.29MMT and 4.285MMT

according to the Ministry of Commerce. China needs around 4.8MMT a month

for its crushing needs. The slower pace of imports is thought to be due

to logistical complications out SAM as opposed to slowing demand, but it’s too

early to tell. The USDA is currently estimating 12/13 soybean imports for

China at 63MMT, although the average analyst estimate according to Bloomberg

has slipped to 59MMT.

Japan bought 37,188MT of food wheat in an S-B-S tender

overnight from Canada and Australia. Articles from Russia said the price

limit for purchasing milling wheat headed for state reserves in Aug-Sept is

RU7,000/MT, or $210/MT ($5.71/bu). They are clearly banking on a very

large crop and declining global prices. The Russian winter grain losses

are being forecast at 1.3-1.6 million hectares vs. earlier estimates for 1.9 million

according to the Ag Minister. Cattle on feed report this afternoon at

2:00. Estimates look like placements at 92.8%, marketings at 92.3% and

Mar 1 on feed at 93.8%.

Overnight maps continue to look very dry for South America,

although haven’t heard whether this is an issue or not. Something to keep

track of nonetheless. Corn basis remains weak. Wheat basis is

steadying. Everyone seems to be of the opinion wheat basis should get

sloppy due to the amount of wheat left on farm. While I agree with that

in principle, it does concern me that logistics remain poor on rail, and that

everyone seems to be of the same opinion on basis. MWK/MWN is reluctant

to trade a carry.

Open interest changes yesterday included another 12,640

contracts of corn, wheat down 690, beans up 1,560, meal down 1,310, soy oil

down 4,480 contracts. Corn open interest just keeps on climbing which is

a short-term positive if the people doing the buying decide to defend their

position. Chinese markets were firmer with beans up 14c, meal down $0.40,

soy oil down 35c, corn up 1.25c, palm down 15c and wheat up 0.25c.

Malaysian Palm Oil was up 47 ringgit at 2,493 (1.51%). Paris Milling

Wheat is up 0.10%, Rapeseed is up 0.16%, corn down 0.22%, UK feed wheat is

unchanged and Canola is unchanged.

Call things a little bit weaker to start off with but keep

an eye on the wires at 8:00am this morning or Monday morning. Odds are

good we did some export business to China per the rally yesterday.

Otherwise, the low volume chop ahead of the March 28th reports could

be setting in.

U.S. Soy Acres May Rise to Record, Survey Shows; Grain

Area Up

2013-03-21 21:49:33.99 GMT

By Jeff Wilson

March 21 (Bloomberg) -- U.S.

farmers will plant the most

soybean acres ever, and corn seeding may rise to the highest

since 1936, according to a survey of 32 analysts by

Bloomberg

News. Wheat acreage may rise to the highest in four

years.

The U.S. Department of

Agriculture is scheduled to release

its estimates, based on a national survey of growers, on

March

28 at noon in Washington.

Below are the estimates of how

much land farmers intend to

plant, in millions of acres.

*T

Crop

Production USDA

Estimates

February

Average

Range 2013

2012

Corn

97.339 96.5-98.5

96.5 97.155

Soybeans

78.351 77.0-80.0

77.5 77.198

All

Wheat 56.32

55.6-57.3 56.0 55.736

Spring

Wheat 12.39

11.91-12.8 n/a

12.289

Durum

Wheat 2.13

2.0-2.3

n/a 2.123

Firm

Estimates

All Spring Durum

Corn Soybeans Wheat Wheat Wheat

============================================================

ABN Amro

Clearing 98.000 78.000

56.20 12.40 2.00

A/C Trading

Inc. 97.500

78.500 n/a n/a n/a

ADM Investor Services 97.000

79.500 56.00 12.40 2.00

Advanced Market Concepts 98.500 77.400

56.50 12.80 2.20

AgriVisor

LLC

97.000 78.500 57.00 12.80 2.20

Allendale

Inc. 96.956

78.342 56.26 12.06 2.18

Alpari

98.000 78.200 n/a n/a n/a

Citigroup Global Markets 96.800 77.600 56.10

12.32 2.19

Commodity Information 97.000

78.200 56.00 n/a n/a

EFG

Group

97.500 78.500 56.50 n/a n/a

Farm

Direction

97.500 78.200 56.20 n/a n/a

Farm

Futures

97.430 79.090 56.12 11.91 2.06

Fintec Group

Inc. 98.000 77.000

56.00 n/a n/a

Grain Service Corp.

98.200 78.000 56.50 n/a n/a

Global Cmd Analytics 96.900

78.100 57.10 n/a n/a

Hightower

Report 97.500

78.500 56.50 12.50 2.10

Jefferies Bache

96.760 78.500 56.85 12.42 2.24

Kropf & Love

97.500 78.500

56.50 12.70 2.00

Linn

Group

96.500 77.500 56.00 n/a n/a

McKeany

Flavell 97.800

77.900 55.60 n/a n/a

Mcquarie

Bank

96.600 79.700 57.30 n/a n/a

Newedge USA

LLC 97.500

78.800 56.80 12.80 2.30

Northstar Commodity

98.200 78.100 55.80 12.35 2.15

PIRA Energy

Group 97.000 78.000

56.10 n/a n/a

Prime Ag Consultants 98.000

80.000 n/a n/a n/a

Rice Dairy

LLC 97.600

78.500 56.06 12.20 2.05

R.J.

O’Brien

97.000 78.500 56.30 12.20 2.10

Risk

Management 96.800

78.000 n/a n/a n/a

Stewart-Peterson

96.500 78.500 56.20 12.40 2.10

U.S. Commodities Inc. 97.500

77.500 n/a n/a n/a

Vantage

RM

97.000 78.500 56.00 n/a n/a

Water Street Solutions 96.800

79.100 56.14 12.05 2.18

U.S. Corn, Soybean Inventories Fell on March 1, Survey

Shows

2013-03-21 21:17:43.537 GMT

By Jeff Wilson

March 21 (Bloomberg) -- U.S.

corn inventories on March 1

probably fell to the lowest in 15 years for the date,

while

soybean stockpiles dropped to the lowest since 2004,

according

to a survey of as many as 31 analysts by Bloomberg News.

Wheat

inventories probably fell to a four-year low.

The U.S. Department of

Agriculture is scheduled to update

its reserve estimates with a quarterly report at noon on

March

28 in Washington. Figures below are in billions of

bushels.

*T

U.S. March 1 Inventory

Forecasts

Average

Range

Previous USDA

March 1, 2012 Dec. 1, 2012

Corn

4.995 4.743-5.248

6.023 8.030

Soybeans

0.948 0.900-1.059

1.374 1.966

Wheat

1.165 1.010-1.249

1.199 1.660

*T

*T

Analyst

Estimates

Corn Soybeans Wheat

===========================================================

ABN

Amro

5.080 0.925 1.055

A/C Trading

Inc.

4.950 0.940 n/a

ADM Investor Services

5.037 0.940 1.193

Advanced Market Concepts

4.783 1.015 1.125

AgriVisor

LLC

4.990 0.955 1.180

Allendale

Inc.

5.071 0.912 1.107

Citigroup Global Markets

4.960 0.984 1.211

Commodity Information

4.975 0.948 1.185

CHS Hedging

Inc.

4.997 0.934 1.191

Doane

Advisory

5.005 0.945 1.185

EFG

Group

5.000 0.960 1.190

Farm

Direction

5.050 1.000 1.170

Farm

Futures

5.248 0.972 1.125

Fintec Group

Inc.

4.743 0.910 1.210

Grain Service

Corp. 5.056

0.928 1.166

Hightower

Report

5.025 0.955 1.200

Jefferies

Bache

4.941 0.936 1.238

Kropf &

Love

4.985 0.930 1.197

Linn

Group

5.020 0.912 n/a

Macquarie

Bank

5.103 0.913 1.207

McKeany

Flavell

5.020 0.900 1.010

Newedge USA

LLC

4.948 0.921 1.205

Northstar

Commodity 4.885

0.911 1.170

Prime Ag

Consulting 5.100

0.940 1.200

Rice Dairy

LLC

4.969 0.925 1.249

R.J.

O’Brien

5.030 0.928 1.179

Risk

Management

5.223 1.059 1.010

Stewart-Peterson

5.020 0.950 1.160

U.S. Commodities Inc.

4.952 0.970 n/a

Vantage

RM

4.750 1.050 1.150

Water Street Solution

4.916 0.926 1.162

Tregg Cronin

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

CHS Hedging, Inc.

The Right Decisions for the Right Reasons

The Right Decisions for the Right Reasons

Thursday, March 21, 2013

Closing Comments 3-21-2013

The grain markets closed mixed today as beans and wheat

reversed rolls today.

Wheat was off 7 cents in CBOT wheat, MPLS wheat was down 7

cents a bushel, KC wheat was down 6 cents a bushel, soybeans bounced rather

strong today up 29 cents, and corn closed up ½ cent on the May contract while

July was unchanged, and new crop December corn was up 1 ½ cents. Outside markets had some pressure with crude

off about a buck and the stock markets under pressure with the DOW closing off 90

points.

More and more estimates are coming out for next week’s USDA

report. Keep in mind that these stock

reports have had a history of limit moves.

The one we had this last January was tame; but this is the report were

the USDA seems to find or lose 200-300 bushels of corn regularly. My personal bias on this report is it will be similar

to the January report and won’t be a major market moving event. But just thinking that could be a little dangerous. As to how it shakes out; right now the market

is looking and seems to be pricing in a bullish type report for corn and

beans. So if that trend continues it

might take a very bullish report to not be disappointing.

Besides the stocks report we will also have planting

intentions; but I look for that to take a back seat to the stocks. You can read or listen to hundreds of reasons

for both a bullish or bearish report and when things are all said and done and

the numbers come out the report should be one that says “we are off to the

races because of the tight balance sheet that just got tighter” or the price

slide from the summer highs should now continue because we curbed enough demand.

The bean number might be as important or perhaps even more

important than the corn number; but it is also much more known because we report

exports and crush on a regular basis.

While the corn usage for ethanol and exports is known; the wild card and

reasons for the swings in recent years has been the feed usage or other

usage. Bottom line is in my opinion the

bean number could be very tight but I don’t think the number will set the

stages for bean prices over the next several months. I think what China does or doesn’t due will

influence beans and I think the tightness in beans will show up in basis.

For corn old crop prices direction could easily follow the

report direction for a couple months; as the report will really be the only big

headline for old crop other than new black swan events. We will have the regular ethanol updates and

export updates; and we will see what margins are doing but we won’t know until

the June report if the market did it’s job finding additional demand or curbing

demand.

For new crop the acres take a back seat because it really

comes down to weather. Now acres can be

important and if we have an extreme above or below estimates it will affect the

markets but the bigger effect will come from what weather does to yield. Bottom line on new crop is it might be very

hard to sustain a major rally if the acres are any place between 95-100 million

acres of corn planted; because anything close to trend line yield produces a

crop between 13.5-15 billion bushels or so.

This year we will use only about 11 billion bushels; so to find 2.5 to 4

billion bushels of demand will be very tough.

That’s not to say that say that higher prices can’t happen; but it won’t

be easy without a repeat of last year’s bad weather.

One thing heard today that I found interesting was that some

72% of producers thought new crop cash corn wouldn’t go back below $5.00. I find it interesting because most advisors

are liking the idea of making sales and it seems to me that we have too much unsold

new crop grain. I think we have a huge

longer term risk in prices should we have a good growing year. Does it mean guys should be making sales here? I am not sure; I think we should on a small

bounce; but more than anything we need to realize the huge possible risk we

have out there. So no I don’t want to be

making tons of sales right here; but I want to realize that every day that goes

by getting us closer to new crop my prices objectives probably should come down

and premium will eventually fade out of the market.

As for other news out there today. We had export sales out; which were horrible

for corn and beans. While the wheat

number was good; but just in line with estimates. Not enough to help wheat turn around the

weakness that it had starting last night.

Basis is still under a little pressure; the recent bounce on

the board just has a little more supply then demand for corn and wheat

both. We are very close to really

widening out nearby corn bid because we can’t find any homes. I think the coverage for later on slots is

smaller than ever. I have basically zero

corn sold for June-September typically I already have a decent deck on. So end users are basically hand to mouth; which

is good and bad; but very volatile. When

they get covered nearby like they are presently bids just start to drop. Buyers or elevators then look for the next slot;

which in this case is also covered. Then

they look at June or July as example; but most producers and elevators don’t

have interest selling June at a discount to the nearby bid; especially with as

tight as corn is suppose to be. So you

just into a stalemate or waiting game.

Elevators and producers get long upfront hoping for basis to appreciate

at sometime; which likely happens if the board goes under pressure or supply

stops. But as long as the supply or

selling continues basis stays under pressure and if it continues to happen for

an extended period of time guys will obtain too much length and be force to sell

it thus push the basis weakness out even further. The other very interesting basis thing

happening is where the final corn product is ending up. I would say only about ¼ to ½ of our corn

over the past several months has went to the same end users that bought it the

past 3-4 years. Part of that is bigger

crops around our traditional end users; but part is the lack of crops in other

areas. This might mean that later on our

area gets tight and basis has to do some work to keep or get the grain coming

in.

Bottom line is look for basis to be very choppy and very volatile.

Please give us a call if there is anything we can do for

you.

Jeremey Frost

Grain Merchandiser

Midwest Cooperatives

800-658-5535

800-658-3670

605-295-3100 (cell)

605-258-2166 (fax)

Overnight Highlights from CHS Hedging's Tregg Cronin

Outside Markets: Dollar Index

down 0.008 at 82.771; NYMEX-WTI down $0.28 at $93.22; Brent Crude down $0.48 at

$108.24; Heating Oil down $0.0053 at $2.8868; Livestock markets are mixed;

Softs are better; Gold up $0.30 at $1608.00; Copper up $0.0100 at $3.4565;

Silver up $0.103 at $28.920; S&P’s are up 0.50 at 1549.50, Dow futures are

up 17.00 at 14,425.00 and Treasuries are weaker.

Mixed equity markets overnight with

the NIKKEI +1.34%, but the CAC 40 -1.00% and the FTSE 100 -0.74%. More

poor European economic data overnight along with more drama in Cyprus is keeping

things under pressure. The Euro-area PMI fell to 46.5 from 47.9 in

February, below the forecasted 48.2, and below the 50.0 contraction/expansion

level. The European recession is not bottoming, and could in fact be

getting worse. As troubling is the fact France’s manufacturing PMI of

43.9 is only slightly better than Greece’s 43.0. I don’t think we’re

prepared for France slipping into recession. In Cyprus, The ECB said

it will cut Cypriot banks off from emergency funds after March 25th

unless the country comes up with a plan to post collateral for a bailout.

The country’s banks are remaining closed as ATM’s run out of cash across the

island. 5-yr Credit Default Swaps for Cyprus are up 55bp to 1,002bp,

while Argentine 5-yr’s re up 165bp @ 3,261. Have to point out the huge

moves going on in the Forex market this morning with the New Zealand Dollar up

over 1.0% against all trading partners, and the Yen is up sharply as well with

the JPYEUR +1.094%, JPYCHF +1.006% and JPYUSD +0.869%. The EURUSD -0.139%.

Jobless claims and existing home sales are on deck in the US today.

Quiet Midwest overnight and only

a skiff in the central plains this morning. The precip event begins

tomorrow in the southern plains with 0.25-0.85” falling in the far eastern reaches

of HRW country. This pushes East over Dixieland Saturday with similar

totals. Sunday will bring more moisture to KS with the entire state

looking at 0.75”. Surrounding states could pick up 0.25”. Monday

and Tuesday will see moisture in the ECB impact mainly OH with totals around

0.25-0.50”. Things then get cold and dry in the 6-10 with the epicenter

of the cold over KY/TN/IL/IN/OH but extending all the way to E-NE/E-KS.

The dryness will be centered over MN/IA/WI. Similar readings in the

8-14. The 6-10 below normal cold readings are the deepest purple I can

remember seeing on these maps.

Mixed trade overnight with weaker grains but firmer oilseeds

as soybeans put together a two-day winning streak for the first time since the

beginning of the month. Overnight wires suggest the oilseed strength

is tied to continued Brazilian shipping delays, and the belief that the

cancelation talk earlier in the week was actually origin or slot switching, not

outright cancelations. See article below. The weakness in

grains seems tied to easier cash markets thanks to heavy far movement of corn

and spring wheat earlier this week. Spreads have been on the defensive,

and cash basis on corn is weak across almost every demand center. Still,

the technical picture is much improved for both corn and wheat, implying

further upside to come, and the continued rise in open interest signals trend

followers getting onboard.

Actually a fair amount of news overnight so check the bottom

of the email for more articles. China released Feb import data overnight

with wheat at 222,519MT, down 40.2% y/y, although the US did ship 57,750MT

which was up sharply from a year ago. Corn imports were 394,090MT, down

24.31% y/y, and all of it coming from the US. Soybeans imports were 2.898MMT,

down 24.33% y/y with all of it coming from the US. Jan-Feb imports of

beans were down 8.97% at 7.681MMT. The soybean shipments could be due

in part to the Chinese New Year, or the willingness to “de-stock” inventories

ahead of South American harvests which as we’re seeing now was a risky

proposition thanks to logistics. Japan bought their 132,777MT of

milling wheat with 76,000MT coming from the US.

Vessel lineups at Brazilian ports continue to rise with 206

boats waiting to load beans, meal and pellets totaling 12.280MMT. Algeria

bought 350,000MT of optional-origin milling wheat at $330/MT C&F, Libya

bought 50,000MT of Hungarian wheat and an Oman flour mill bought 10,000MT of

Indian-origin milling wheat. A Bloomberg article, see below, quoted

an official at the second largest feed mill in China who said China may have a

20-30MMT annual shortage in feed grains within 2-3 years. He said China’s

meat consumption could expand 25% within 5-years. He also said China

would import 10MMT of corn per year now if there were no policies restricting

imports. Investment bank Credit Suisse cut their 12-month corn price

forecast to $6.00/bu. Wheat to $6.90 and beans to $13.50.

Open interest changes yesterday included corn up another

14,200 contracts, wheat up 1,940, beans down 400, meal down 3,550 and oil up

2,160. Since the price low on March 7th, corn open interest

is up 97,828 contracts signaling a piling on of trend type following funds, and

giving this rally some legitimacy. Chinese markets were firmer

overnight with soybeans up 11.75c, meal up $6.20, oil up 56c, corn unchanged,

palm up 72c and wheat down 0.75c. Malaysian Palm Oil up 15 ringgit at

2,456. Paris Milling Wheat is currently down 0.51%, Rapeseed up 0.27%, UK

Feed wheat down 0.75% and corn up 0.76%.

Call things mixed to start with an eye on export sales in 10

minutes. Corn sales are expected at 0-300,000MT, beans at 150-700,000MT

and wheat at 300-825,000MT. Another big wheat number (700+) would go a

long ways to giving legitimacy to the current rally. We are running into

producer selling and most basis levels are on the retreat. Keep this in

mind as we climb higher towards more marketing objectives. Funds still

short a pile of wheat. Hog board crush spreads are hitting fresh contract

lows.

China

Has No Reason to Cancel Soybean Orders, CHS’s Liu Says

2013-03-21

10:05:10.898 GMT

By Bloomberg News

March 21 (Bloomberg) -- Chinese

crushers have “no ability

or

real intention” to cancel soybean orders, Liu Guoqiang,

general manager of CHS (Shanghai) Trading Co., said at a

forum

in Kunming. CHS is a U.S.-owned grain trader.

Liu’s response came after

Shandong Chenxi Group, a Chinese

soybean crusher and trader, said this week that it plans

to

cancel orders for almost 2 million metric tons of

Brazilian

cargoes on shipment delays.

“Soybeans are needed in China and supplies are hard

enough

to

buy from March to May,” Liu said. “The comments to media by

some

Chinese crusher wanting to cancel 2 million tons of

soybeans

may have other motivations.”

Only one cargo of soybeans was

resold by a crusher, and

there are no cancelations and won’t likely be any in the

“near” future, according to Liu.

China

May Have 20m Tons Shortage of Coarse Grain, Feed Mill: Yi

2013-03-21 07:10:09.204 GMT

By Bloomberg News

March 21 (Bloomberg) -- China may have 20-30m tons of

annual

shortage in feed grain supply in 2-3 years, boosting

needs for imports, Yi Ganfeng, vice president of Beijing

Dabeinong Technology Group Co., the country’s

second-biggest

feed miller, said on the sideline of the JCI grain

conference in

Kunming.

* As China’s livestock industry matures, feed

mills will

prefer to use bulk-commodity grain,

including corn and dried

distillers’ grains, in place of

traditional materials such

as oilseed meal, used by smaller farms

now, Yi says

*

China’s meat demand may expand about 25% from current level

in about 5 years, spurring consumption

of feed grain, Yi

says

*

China may import 10m tons of corn a year now if there were

no policies restricting imports, Yi says

Oil

Companies Using RINs to Remove Ethanol Law, Growth CEO Says

2013-03-20 13:24:30.99 GMT

By Mario Parker

March 20 (Bloomberg) -- Oil

companies are manipulating the

value of Renewable Identification Numbers, or RINs,used

to help

the government track biofuel use, in an effort to

eliminate the

country’s ethanol mandate, Growth Energy Chief Executive

Officer

Tom Buis said today on a conference call.

* Growth Energy is Washington-based ethanol trade

group

Mexico

Corn Production Will Rise in 2013, USDA Unit Says

2013-03-20 19:06:01.573 GMT

By Steve Stroth

March 20 (Bloomberg) -- Output

in the year starting Oct 1

will rise to 22mt from 21.5mt a year earlier, the U.S.

Department of Agriculture’s Foreign Agricultural Service

said in

a report posted today on its website.

* Sorghum production will be 6.8mt, compared with

6.9mt a yr

earlier

Tregg Cronin

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

Market Analyst

800-328-6530

651-355-6538

651-355-3723 fax

CHS Hedging, Inc.

The Right Decisions for the Right Reasons

The Right Decisions for the Right Reasons

Subscribe to:

Comments (Atom)