Markets where called better this a.m. behind a firmer overnight session, supportive outside markets, and oversold conditions.

In the overnight session corn was up 7-8 cents, beans where up 12-14, KC wheat was 11-12 firmer, MPLS 8-12 firmer, and CBOT wheat was 9-12 cents firmer. At 9:20 outside markets are adding support with crude up a little over a dollar a barrel, equities have the DOW up 90 points, the US dollar is softer with the Sept down 393 at 75.435, and European wheat is 3-3 ½ percent firmer.

With the huge sell off we have seen over the past couple of weeks a little profit taking or position squaring into this week’s stock’s and acre report is expected; perhaps that can lead to the upside getting over done as the next couple of day’s sessions unwind.

Fundamentally not much has changed in our markets since the last USDA crop report; but we will have some potential changes off of the quarterly stocks and planted acres number which comes out Thursday June 30th.

Idea’s for the planted acres on this week’s report are 90.7 million acres of corn; which is a big increase from last year’s 88.2 million acres; but a decrease off of the March report and unchanged from the June report where they updated acres even though they typically don’t. Soybean acres are pegged at 76.5 million acres which is off from last years 77.4, but very close to where the March numbers came in at. Spring wheat is pegged at 13.35 million acres which is a slight decrease from last year’s 13.7; but the market is expecting a rather sizeable decrease from the March planting intentions report where 14.4 million acres where estimated.

In my opinion planted acres above 92 million for corn shoot us limit down potentially starting a change to the balance sheet for a long time; while acres below 89 million or so potentially push our markets limit up. One of the big wild cards will be and is the stock’s numbers. If you remember the couple of year’s these reports have had rather big swings from time to time; where they seem to find or lose a couple hundred million bushels on a regular basis.

Even though the report out this week should really set the stages for fundamental price direction for some time to come our longer term price direction and actual fundamentals really come down to mother nature; what the weather does and what money flow does or doesn’t do continue to outweigh what one things logically should happen.

As one can see I didn’t get these comments emailed out this a.m. but the thoughts of today’s price action where in line as our markets closed firmer; and sharply firmer in many of the markets lead by corn and supportive outside markets. Technically we may set stages where Thursday’s report can act as a catalyst for confirmation that markets have reversed back towards the upside with last week’s sell off being a last ditch panic sell or the price action the past couple of days will end up looking like a normal correction in markets that technically are on the weak side of things.

Personally I love the price action the past three to four sessions if we are going to have an attempt to see higher prices; as we seen basically an exhaustion gap on last Thursday’s opening followed by doji’s left on the chart as we bounce well off of the lows. The market then went back and tested those lows yesterday and has since bounced rather well. Fundamentally weather is ideal in many of the areas that have the crop planted; but plenty of areas have lacked heat units while overseas there has been some talk of dryness in the Russia

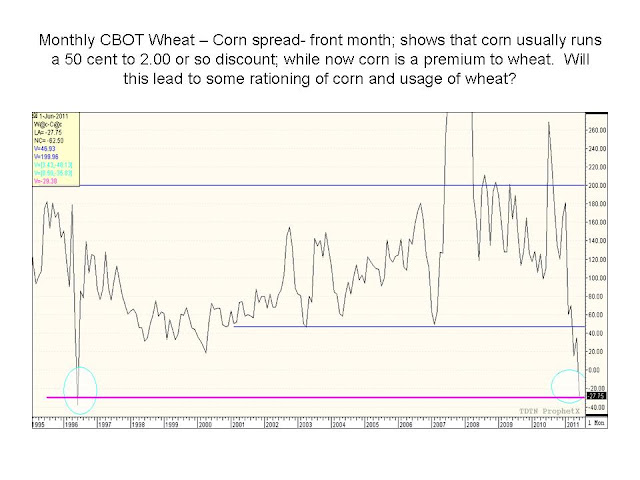

The price action of the Equities, crude, and the US dollar is also on the supportive side or at the very least has re-opened the doors that the sell off the past month or so was just a correction in longer term bull markets; this would be another supportive factor for our grains. For more technical information please take a look at the attached charts.

When the dust settled out today we seen old crop corn up 22-26 cents, Dec corn was up 26, KC wheat was 15-16 cents firmer, MPLS wheat was up 30, CBOT wheat was up 18-21, beans where 1-4 cents better, crude over 2.50 a barrel firmer, equities up strong with the DOW 145 points higher, and the US dollar was softer with the Sept down 393 at 75.435.

Overall a good day to see and probably a long over due day with our oversold conditions that we have had in our markets with the massive sell off we have seen recently. Basis feels firmer across the board for all of our grains; part is from logistics so that makes it hard to judge; but overall there seems to be more demand then supply. The birdseed markets are similar in that there is very little supply out there; but the bids are even harder to find; so that market is really a waiting game; if buyers need coverage it won’t be cheap but if you have to call to find bids they won’t be as high as one hopes.

As a reminder we do have our MWC Marketing Hour Round Table Wednesday in Onida at 3:30; we hope to see you there.