Information about grain markets and info to help producers to market crops. See how various grain marketing strategies can effect ones average price. We will be posting various potential trade and option strategies along with marketing decisions made on our mock farms. Now helping daily market minute in empowering farmers to fight big ag and become price makers. Education to help farmers manage crop risk such as corn, soybean, and wheat prices. Using futures, options, basis contracts etc.

Showing posts with label $ 20 million profit trading grains?. Show all posts

Showing posts with label $ 20 million profit trading grains?. Show all posts

Sunday, September 20, 2015

Sunday, August 30, 2015

Friday, May 11, 2012

Beans get smacked! - Neutral Nick update time

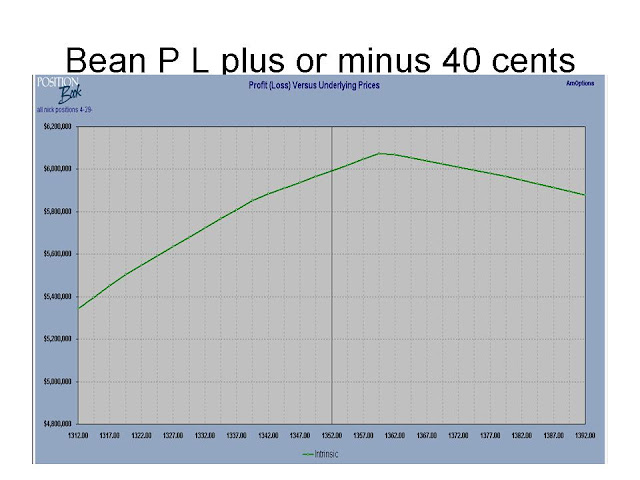

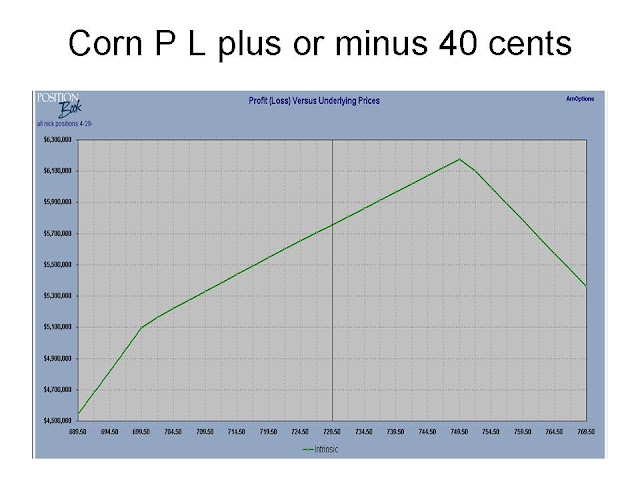

Beans got smacked today so it is time for Neutral Nick to look at his positions in an effort to try and manage his risk.

He went threw all of his positions and felt good about all of the months and all of the commodities other then July beans.

For corn he felt that his p & l graphs where at good support areas and didn't feel the need to chase in which might cause a lot of whipsaw action.

Same for wheat.

Before his soybean adjustments which I will display below he has overall profits in most of the trades he has on and his expiration profits giving him a much more potential. Those charts have changed since his last update about a week ago. You can find them at http://grainmarketingplans.blogspot.com/2012/05/neutral-nick-update-nearly-200k-booked.html

Soybeans today broke some major support and could very well see plenty of follow threw weakness; then again if you look at the report a couple days ago you might think beans have plenty more upside.

The corn and wheat markets are at the bottom end of the ranges they have been for some time; if we don't bounce Mr Neutral Nick might have to look to adjust sometime in the near future as he does have put options sold that are now close to or in some cases slightly in the money. As mentioned before Neutral Nick this time around is using a little bias and his bias for those markets are A we are near a harvest low for wheat and we have year over year month over month decreasing supplies and B the cash corn market has shown no weakness leaving the cheapest spot to buy corn still the board for many so he isn't wanting to adjust at this time and C the new crop corn showing a yield of 166 is a little premature; Nick and myself are in the camp that we should see a weather scare at some point.

Here are Nick's updates and his corresponding bean graphs.

His only trades this week are the sale of 50 July 13.50 puts and 100 of the July 14.50 calls. With us getting closer to the June expiration of these options this will probably be the last time he sells any July options. He might buy some; but one thing he has to watch out for is Gamma Risk.

He went threw all of his positions and felt good about all of the months and all of the commodities other then July beans.

For corn he felt that his p & l graphs where at good support areas and didn't feel the need to chase in which might cause a lot of whipsaw action.

Same for wheat.

Before his soybean adjustments which I will display below he has overall profits in most of the trades he has on and his expiration profits giving him a much more potential. Those charts have changed since his last update about a week ago. You can find them at http://grainmarketingplans.blogspot.com/2012/05/neutral-nick-update-nearly-200k-booked.html

Soybeans today broke some major support and could very well see plenty of follow threw weakness; then again if you look at the report a couple days ago you might think beans have plenty more upside.

The corn and wheat markets are at the bottom end of the ranges they have been for some time; if we don't bounce Mr Neutral Nick might have to look to adjust sometime in the near future as he does have put options sold that are now close to or in some cases slightly in the money. As mentioned before Neutral Nick this time around is using a little bias and his bias for those markets are A we are near a harvest low for wheat and we have year over year month over month decreasing supplies and B the cash corn market has shown no weakness leaving the cheapest spot to buy corn still the board for many so he isn't wanting to adjust at this time and C the new crop corn showing a yield of 166 is a little premature; Nick and myself are in the camp that we should see a weather scare at some point.

Here are Nick's updates and his corresponding bean graphs.

His only trades this week are the sale of 50 July 13.50 puts and 100 of the July 14.50 calls. With us getting closer to the June expiration of these options this will probably be the last time he sells any July options. He might buy some; but one thing he has to watch out for is Gamma Risk.

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

commodity price risk management tools strategies grains futures options money cash flow,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Wednesday, May 9, 2012

How do I decide what type of protection?

I was looking today at what gives me the best protection ahead of the USDA crop report.

To answer that question one has to ask more questions; such as how long do I want protection; what type of protection do I need if we move X cents or X dollars up or down......how much do I want to spend.

So after one answers those questions the next thing to do is the what if's; for me I use position book from RJO and run various what if's.

Today I ran the example of if I want to spend $50k in protection using Dec put options what gives me the best bang for my buck. Do i buy out of the money options? In the money? Deep out of the money? Etc

So I decided to run threw some what if's using Dec corn futures and various strikes. I believe that I want to have the trigger pulled by July 4th ish; on the cash side; so i ran what if's or theoretically values based on July 6th.

I took 50k and bought as many put options as I could using the following strikes.

5.20 or ATM puts which i figured at 41-42 cents i could buy about 24 of them

5.00 or OTM put which i figured at 31-32 cents i could buy about 32 of them

4.50 or Deep OTM puts which i figured i could buy 77 of them

4.00 or Very Deep OTM (OTM out of the money) which i figured i could buy about 286 of them.

I didn't take into account the more commissions with the more quantity; but here is what i found that gains or losses to be (theoretically based on no volatility changes) at these various futures levels on the Dec Futures

6.00 Dec Futures - all four of the trades are big losers; with the ATM losing the least at 38k loss; followed by the 5.00 puts which lose about 41k, then the 4.50 puts which loss 45k, and lastly the 4.00 puts have lost about all value down about 48k. Now if we are a producer this is the best option if you don't have 100 % protection because it means we have rallied 80 cents and should have more then paid for the 50k paid in protection

5.00 Dec Futures...give the Higher the strike the more profit. The 5.20 would be up aprox 2500, the 5.00 strikes about 1200, the 4.50 would be losing about 4500 and the 4.00 strikes would have lost you about 14k

4.50 Dec Futures....Here is where you see them all start to make money; this time however the more puts you have the more they make; so the best performance at 4.50 on July 6th ish would be the 4.00 puts which should be up about 75k, followed by the 4.50 puts which should be up about 60k, then followed by the 5.00 up about 48k, and lastly the at the money 5.20 puts are now up only 42k

4.00 Dec Futures....this levels and below is where you really see how well leverage can work for one.....the pattern is the same you are better off having bought more out of the money puts then you are at the money puts even though we are not yet in the money on the 4.00 puts they lead by far; you would now have turned your 50k investment into about 306k profit, your 4.50 would be 176k, your 5.00 would be 111k, and your 5.20 puts would be up about 94k profit

3.50 Dec Futures.....This is where you hit the home run so to speak; turning your 4.00 puts that are worth less then 4 cents when you buy them into about 55 cents each; having bought 286 of them you are now up nearly 750,000 in profits, the others also do good; but not even close versus having the many more 4.00 puts; the 4.50 puts would have about 335k in profit; the 5.00 puts would be up about 111k, and the 5.20 puts up about 94k

Bottom line when deciding what type of coverage you are looking for don't forget to look at the what if's; also keep in mind that the what if's i am looking at are based on 60 days from now; not expiration; as at expiration 4.00 dec futures don't make you any money at 4.00 puts; but in the shorter term they could make you a lot of money

Overall it seems to make sense to buy more OTM if you plan on only holding a short term; they don't perform as well in a sideways market nor an up market; but they are in another league as for performance in a down market

Please give me a call if you have questions

and as always make sure you understand that futures and options are very risky

Here is a screen shot of the what if's that i used in the above example

To answer that question one has to ask more questions; such as how long do I want protection; what type of protection do I need if we move X cents or X dollars up or down......how much do I want to spend.

So after one answers those questions the next thing to do is the what if's; for me I use position book from RJO and run various what if's.

Today I ran the example of if I want to spend $50k in protection using Dec put options what gives me the best bang for my buck. Do i buy out of the money options? In the money? Deep out of the money? Etc

So I decided to run threw some what if's using Dec corn futures and various strikes. I believe that I want to have the trigger pulled by July 4th ish; on the cash side; so i ran what if's or theoretically values based on July 6th.

I took 50k and bought as many put options as I could using the following strikes.

5.20 or ATM puts which i figured at 41-42 cents i could buy about 24 of them

5.00 or OTM put which i figured at 31-32 cents i could buy about 32 of them

4.50 or Deep OTM puts which i figured i could buy 77 of them

4.00 or Very Deep OTM (OTM out of the money) which i figured i could buy about 286 of them.

I didn't take into account the more commissions with the more quantity; but here is what i found that gains or losses to be (theoretically based on no volatility changes) at these various futures levels on the Dec Futures

6.00 Dec Futures - all four of the trades are big losers; with the ATM losing the least at 38k loss; followed by the 5.00 puts which lose about 41k, then the 4.50 puts which loss 45k, and lastly the 4.00 puts have lost about all value down about 48k. Now if we are a producer this is the best option if you don't have 100 % protection because it means we have rallied 80 cents and should have more then paid for the 50k paid in protection

5.00 Dec Futures...give the Higher the strike the more profit. The 5.20 would be up aprox 2500, the 5.00 strikes about 1200, the 4.50 would be losing about 4500 and the 4.00 strikes would have lost you about 14k

4.50 Dec Futures....Here is where you see them all start to make money; this time however the more puts you have the more they make; so the best performance at 4.50 on July 6th ish would be the 4.00 puts which should be up about 75k, followed by the 4.50 puts which should be up about 60k, then followed by the 5.00 up about 48k, and lastly the at the money 5.20 puts are now up only 42k

4.00 Dec Futures....this levels and below is where you really see how well leverage can work for one.....the pattern is the same you are better off having bought more out of the money puts then you are at the money puts even though we are not yet in the money on the 4.00 puts they lead by far; you would now have turned your 50k investment into about 306k profit, your 4.50 would be 176k, your 5.00 would be 111k, and your 5.20 puts would be up about 94k profit

3.50 Dec Futures.....This is where you hit the home run so to speak; turning your 4.00 puts that are worth less then 4 cents when you buy them into about 55 cents each; having bought 286 of them you are now up nearly 750,000 in profits, the others also do good; but not even close versus having the many more 4.00 puts; the 4.50 puts would have about 335k in profit; the 5.00 puts would be up about 111k, and the 5.20 puts up about 94k

Bottom line when deciding what type of coverage you are looking for don't forget to look at the what if's; also keep in mind that the what if's i am looking at are based on 60 days from now; not expiration; as at expiration 4.00 dec futures don't make you any money at 4.00 puts; but in the shorter term they could make you a lot of money

Overall it seems to make sense to buy more OTM if you plan on only holding a short term; they don't perform as well in a sideways market nor an up market; but they are in another league as for performance in a down market

Please give me a call if you have questions

and as always make sure you understand that futures and options are very risky

Here is a screen shot of the what if's that i used in the above example

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

Grain Markets and Grain Closing Commentary,

Grain Markets Comments,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

opening grain comments,

option selling,

Option Strategies - Futures,

Pricing Options

Sunday, May 6, 2012

Neutral Nick Update - Nearly 200k booked profits

It's been a while since we heard from our mock trading character Neutral Nick. That is both good and bad; good in that he hasn't been over trading and bad that he hasn't done a good job following up and monitoring his positions as much as he should be.

He recently had his May options expire; in which he left most expire worthless; both the ones he owned and had sold. But he did have some soybean options that left him long; he chose to get out of them on the close on Friday.

Net with all of his May options expiring and his now turned futures positions Nick booked $193,437.50 profit before his costs and commissions.

Under normal full service brokers he would have paid about 10,800 in commissions; discounted online brokers could have been much less.

For his new trades or updates he has plenty of them with it being some time since he has followed up.

For corn his updates are buying back all of his cheap call options sold for nice profits and selling other options to pay for them as well as some more deferred options that fit his market ideas so he did the following basis Friday's close

Bought 70 CN 700 calls

Bought 120 CN 750 calls

Sold 50 CN 600 puts

Sold 50 CU 600 calls

Sold 50 CZ 600 calls

For soybeans he sold 100 of each of the following

July 1500 calls, 1450 puts

Nov 1600 calls, 1200 puts

For wheat he bought back 40 of the July 8.00 calls that he had sold and then sold 50 of each of the following

Sept 7.00 calls

Sept 6.00 puts

Dec 6.00 puts

Dec 7.50 calls

Overall the one thing you notice is he tried to take away some gamma risk and tried to sell more deferred options; his preference is out of the money with about 5 months left. He also bought back and placed trades that follow his bias

Below are his P L Graphs; this doesn't include the nearly 200k winner he booked above; also keep in mind that he has risk between commodities and between different months.

Following that are each commodity broke down per contract month as he is looking to book consistent winners every time an option expires via continuing to sell time and volatility and that is what the above trades are trying to accomplish.

Keep in mind that he does have plenty of risk in in strategy

He recently had his May options expire; in which he left most expire worthless; both the ones he owned and had sold. But he did have some soybean options that left him long; he chose to get out of them on the close on Friday.

Net with all of his May options expiring and his now turned futures positions Nick booked $193,437.50 profit before his costs and commissions.

Under normal full service brokers he would have paid about 10,800 in commissions; discounted online brokers could have been much less.

For his new trades or updates he has plenty of them with it being some time since he has followed up.

For corn his updates are buying back all of his cheap call options sold for nice profits and selling other options to pay for them as well as some more deferred options that fit his market ideas so he did the following basis Friday's close

Bought 70 CN 700 calls

Bought 120 CN 750 calls

Sold 50 CN 600 puts

Sold 50 CU 600 calls

Sold 50 CZ 600 calls

For soybeans he sold 100 of each of the following

July 1500 calls, 1450 puts

Nov 1600 calls, 1200 puts

For wheat he bought back 40 of the July 8.00 calls that he had sold and then sold 50 of each of the following

Sept 7.00 calls

Sept 6.00 puts

Dec 6.00 puts

Dec 7.50 calls

Overall the one thing you notice is he tried to take away some gamma risk and tried to sell more deferred options; his preference is out of the money with about 5 months left. He also bought back and placed trades that follow his bias

Below are his P L Graphs; this doesn't include the nearly 200k winner he booked above; also keep in mind that he has risk between commodities and between different months.

Following that are each commodity broke down per contract month as he is looking to book consistent winners every time an option expires via continuing to sell time and volatility and that is what the above trades are trying to accomplish.

Keep in mind that he does have plenty of risk in in strategy

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

commodity price risk management tools strategies grains futures options money cash flow,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Sunday, March 11, 2012

Neutral Nick Update 3-11-12

Neutral Nick updated today; first time in nearly a month.

I hope to post more screen shots of his present positions later in the week; one thing he is trying to do is not trade as much as last year and watch his gamma exposure a little closer. He also isn't getting caught up in selling just one certain month of options. I.E. last year he was mainly selling July options and didn't sell any later then that; towards the end of his run his gamma exposure was just too much; that is part of the reason you see him in options that are near term all the way to some that are out in Dec.

I hope to post more screen shots of his present positions later in the week; one thing he is trying to do is not trade as much as last year and watch his gamma exposure a little closer. He also isn't getting caught up in selling just one certain month of options. I.E. last year he was mainly selling July options and didn't sell any later then that; towards the end of his run his gamma exposure was just too much; that is part of the reason you see him in options that are near term all the way to some that are out in Dec.

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Friday, February 17, 2012

MWC Marketing Hour Round Table

I put up an interesting trade this week in our weekly mock trading session.

It was a hedge trade......well kind of

the trade was buying 2 May 6.00 Corn puts and sell 1 8.00 Dec wheat call

below is some of the thinking i had on in the agweb.com marketing old and new crop discussion thread

http://discussions.agweb.com/showthread.php?14346-Marketing-Old-Crop-and-New-Crop-2012&p=225650#post225650

-------------

one strategy that we looked at in our marketing meetings this week was selling dec wheat calls to buy may and july corn puts

based on theory that dec-dec corn-wheat spread has corn well under valued versus wheat.....so selling a call in wheat instead of corn in hopes that if it turns into a HTA corn has gained some of the 1.20 or so discount that it presently is

i think the level we used was buying 2 6.00 may corn puts and selling 1 dec 8.00 wheat call for a small credit

the reason we used may instead of july or dec is protection cost of only 14-15 cents or so; plus if market breaks i don;t think new crop breaks nearlly as hard; i think breaks or rallies will be lead by old crop corn.........so if i want to protect a price break i want to protect the area that has the most risk......in this case old crop corn

it is much more risky and tricky to manage then using the same month and same commodity but it does have some reasoning behind it

any thoughts on the trade

selling 1 dec 8.00 to 8.50 cbot wheat call to buy 2 6.00 ish may corn puts......as protection against corn.....and a sale on top side for corn

It was a hedge trade......well kind of

the trade was buying 2 May 6.00 Corn puts and sell 1 8.00 Dec wheat call

below is some of the thinking i had on in the agweb.com marketing old and new crop discussion thread

http://discussions.agweb.com/showthread.php?14346-Marketing-Old-Crop-and-New-Crop-2012&p=225650#post225650

-------------

one strategy that we looked at in our marketing meetings this week was selling dec wheat calls to buy may and july corn puts

based on theory that dec-dec corn-wheat spread has corn well under valued versus wheat.....so selling a call in wheat instead of corn in hopes that if it turns into a HTA corn has gained some of the 1.20 or so discount that it presently is

i think the level we used was buying 2 6.00 may corn puts and selling 1 dec 8.00 wheat call for a small credit

the reason we used may instead of july or dec is protection cost of only 14-15 cents or so; plus if market breaks i don;t think new crop breaks nearlly as hard; i think breaks or rallies will be lead by old crop corn.........so if i want to protect a price break i want to protect the area that has the most risk......in this case old crop corn

it is much more risky and tricky to manage then using the same month and same commodity but it does have some reasoning behind it

any thoughts on the trade

selling 1 dec 8.00 to 8.50 cbot wheat call to buy 2 6.00 ish may corn puts......as protection against corn.....and a sale on top side for corn

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Neutral Nick Update

Well it's been a couple week's since Neutral Nick jumped back on the scene; so it is about time for an update.

Below you will see some screen shots showing Nick's updates and projections; keep in mind this time nick is much more diversified into the months he has options sold and purchased. Generally he has purchased a few nearby options and sold deferred options. He also has used his idea's on where spreads go to decide how to position himself. His goal is no longer to stay 100,000 delta short. His system this time is trying to make about a million dollars in each of the grains; without huge margin exposure; watching his gamma risk and not building such a huge and unrealistic mountain if you will.

Check out his info below.

Below you will see some screen shots showing Nick's updates and projections; keep in mind this time nick is much more diversified into the months he has options sold and purchased. Generally he has purchased a few nearby options and sold deferred options. He also has used his idea's on where spreads go to decide how to position himself. His goal is no longer to stay 100,000 delta short. His system this time is trying to make about a million dollars in each of the grains; without huge margin exposure; watching his gamma risk and not building such a huge and unrealistic mountain if you will.

Check out his info below.

The above graph on his delta position is really one thing that needs to be managed. A couple of reasons. A) so he doesn't swing too direction bias and stays "neutral" so to speak B) So he can help control his margin cost. What is his plan to do that; take a little off the top side via near term closer to the money options that have a big gamma advantage over other options he has sold or is selling.

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Monday, February 6, 2012

Mock Trading Update

last week we did add a few trades during our Mock Trading session;

I adjusted my long 6.00 march puts via selling a 6.40 march corn put

I also adjusted my short July put via the sale of a 7.00 July corn call

Other new trades that where placed include Kevin with a long soybean contract versus 2 short wheat contracts

Scott went short some CBOT wheat at 674 with a stop of 6.85 and an objective of 6.50

Duane went long 2 March Wheat with a stop at 6.55 while going short 3 March corn

Please stop in Onida this Wed if you would like to join in on the fun; as it is great for learning.

I adjusted my long 6.00 march puts via selling a 6.40 march corn put

I also adjusted my short July put via the sale of a 7.00 July corn call

Other new trades that where placed include Kevin with a long soybean contract versus 2 short wheat contracts

Scott went short some CBOT wheat at 674 with a stop of 6.85 and an objective of 6.50

Duane went long 2 March Wheat with a stop at 6.55 while going short 3 March corn

Please stop in Onida this Wed if you would like to join in on the fun; as it is great for learning.

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Neutral Nick is back

Neutral Nick our mock trading character is back; this time with a little different rules and different game plan. Not just focused on his delta position; nor does he no longer have an unlimited checkbook. Plus he is planing on rolling things out this time; so no real end date.

Here are his trades to start off; many off of July futures; but some off of the Dec futures too.

Here are his trades to start off; many off of July futures; but some off of the Dec futures too.

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Wednesday, January 25, 2012

Farm Direction Forward - Opening Grain Market Comments soft outside markets

Below are opening comments as well as a forward from Kevin Van Trump who

will be one of the speakers for next week’s grain marketing workshop that we

are sponsoring in Pierre on Feb 2nd at the Ramkota at 10:00 a.m.; Ed

Usset will be the other presenter.

Please give us a call or shoot us an email to RSVP for what should be a

great time.

Markets are called mixed to supportive this a.m. behind a firmer

overnight session; outside markets are a little weak and most calls are

slightly below where we left off the overnight session at.

In the overnight session we saw corn up 3 on the old crop while new crop

was off 2, beans unchanged to down a couple,

MPLS wheat was 4 higher, KC wheat was up 3, and CBOT wheat was up

5. At 9:00 outside markets have crude

down a little over a dollar a barrel, equities are weaker with the DOW down 82

points, and the US dollar is firmer up 379 on the cash index at 80.247.

Not much for new news out this a.m.

The rumors

Labels:

$ 20 million profit trading grains?,

$40 million for producer trading grain,

$50 Beans,

$50 corn,

$50 Wheat?,

600% ROA,

Charts and Strategies,

Commentary on Commodities,

grain trading hour,

Leverage Optoins Futures,

mock trading,

Neutral Nick - A Mock Character with a Grain Marketing Plan for soybeans corn and wheat that focuses on option premium collection to help him get the highest price possible for his grain,

Nick Gets Rich,

nick update ahead of usda report,

option selling,

Option Strategies - Futures,

Pricing Options

Thursday, July 7, 2011

grain market comments 7-7-11 price in commodities just a chance to sell?

Markets are called mixed to better this a.m. behind firmer outside markets with a mixed overnight session that saw wheat in the red and the row crops positive.

In the overnight session corn was up 5-6 cents, beans where up 5-6 cents, KC wheat was down 9, MPLS wheat was off 4, and CBOT wheat was off 4 cents also. At 9:05 outside markets have European wheat off about 2 %, equities are firmer with a better then expected jobless claims as the DOW is up 75 points, crude is 1.90 firmer, and the US dollar is softer with the Sept at 75.320 down .120.

We do have a little grain related news out there today; first off we seen export business for wheat go the other direction last night as Egypt bought Russian wheat which has many talking about our wheat being over priced. In other export news we did have a reported sale of corn to China ; 540 k ton and then 300 k tons to unknown which is assumed to be China

Talk of the weather starting to get too dry in the eastern corn belt and a possible ridge building later in July is also leading the headlines. We really should move into a weather market especially if the last USDA report is accurate in that we have a little more cushion on our balance sheets then we previously did. Yield will end up driving prices by the look of things and the yield will be determined by weather; outside markets along with the money flow that they help create will be important; but it really comes down to weather. Demand has remained good and margins are rather good for most of the users of corn.

The markets did open and have continued a mixed direction; at around 10 we have CBOT wheat up 2-3 cents, KC wheat off 12 cents, MPLS wheat off about a dime, while corn is 11-14 cents better, and beans are 15-20 cents firmer; while outside markets really haven’t changed. It appears to be a little short covering on the CBOT wheat; while funds look to be selling the ownership off a little in the other wheat markets behind the thoughts that our wheat is becoming expensive.

As the day progress we did see the markets change up a little bit as the row crops lost a little steam while wheat managed to bounce a little off of their lows; outside markets continue to be supportive with the DOW now up 125 points as of about 1:30.

When the grains closed we saw KC wheat off 2-3 cents, MPLS wheat off 2-3 cents, CBOT wheat was up 7 ½ , beans where up 15-19, corn up 1-7 cents (with the July up a penny and Dec up 7), and the equities ended with the DOW up 93 points.

Overall a mixed day; rather interesting that we seen the Sept CBOT wheat contract showing strength over the deferred contracts; perhaps it was simply some short covering. But any time real rallies have started it is usually the front month of CBOT leading the way.

Technically we seen corn go back and fill it’s gap on the Dec contract; then close back below that old support new resistance level. The price action seen the past couple of days since the report is rather similar to the price action we seen in 2008 when that big bull market turned into a big bear market. The crop report in 2008 gave us a 64 cent break from the highs the day before the report to the lows the day after the report; we then followed that up with a 48 cent rally from the lows the day after the report and then the meltdown started back up as we slide all the way down to from a 7.99 high to a low of 2.90. The price action on the Dec contract the past couple of days threw the last report is very similar; in that we broke 67 cents from our highs the day/night before the report to our lows the day after the report and then the past three days have bounced 46 cents from those lows.

Who knows what the next coming week’s and months will be like; the potential for a 2008 repeat has to be considered when looking at risk management. Outside market price action has hit and miss been similar to 08 and scary thing is the fact that the funds have more ownership now then they did back then. Yield is yet to be determined and the one positive that have going for us now that we didn’t back then is a feeling of strong demand; which is being lead by old crop corn. If we start to see basis pressure or a even a hint of coverage complete for end users one might really need to turn the marketing ideas much more aggressive if you are undersold at levels that despite the recent break are very profitable.

The birdseed market is one of those markets that is starting to display good coverage; sunflowers are still very tough to buy but the market feels like they are tougher to sell; the biggest wild card for that market will probably be when weather allows for a harvest; if the harvest is late there becomes the potential for little to no product creating a market where the sellers once again are in control.

Please give us a call if there is anything we can do for you.

Sunday, June 12, 2011

Neutral Nick update up over 18 million; not bad on 300,000 bushels

Neutral Nick updated his position on a day when he probably should have simply exited everything with a rather nice 18 million or so gain.

Mr Neutral did do something a little different today as he took some off the top and took a little risk away; but still if he would have simply closed his positions he wouldn't have had any risk going to the bank and cashing in. The reason why Nick didn't do the right thing is because it wasn't in his plan; perhaps next week or in the next few days he will change and get out like he should?

Today's trades where as follows in soybeans he bought 190 of the 14.00 July soybean calls; which got him back to around 100k bushels of sold in delta terms.

For corn he sold 2000 of the 7.80 puts, sold 670 of the 8.00 calls, and purchased 1750 of the 7.50 calls. Once again all July; and if one recalls his marketing plan will end in 12 days one way or another as that is when all of the July options expire.

For wheat he used July CBOT options and sold 1310 of the 7.80 calls, purchased 1000 of the 7.50 puts, purchased 500 of the 7.30 puts and purchased 550 of the 8.00 calls.

Below is a consolidated view of all of his trades as well as profit projected and present.

A couple things that really stick out are the amount of trades needed or done for corn and wheat versus soybeans. In the beans he has had to trade far less quanity and he is up more.

Keep in mind that futures and options are risky and not suitable for all and past performance doesn't mean similiar future results nothing in this blog is a trading reccomendation.

Mr Neutral did do something a little different today as he took some off the top and took a little risk away; but still if he would have simply closed his positions he wouldn't have had any risk going to the bank and cashing in. The reason why Nick didn't do the right thing is because it wasn't in his plan; perhaps next week or in the next few days he will change and get out like he should?

Today's trades where as follows in soybeans he bought 190 of the 14.00 July soybean calls; which got him back to around 100k bushels of sold in delta terms.

For corn he sold 2000 of the 7.80 puts, sold 670 of the 8.00 calls, and purchased 1750 of the 7.50 calls. Once again all July; and if one recalls his marketing plan will end in 12 days one way or another as that is when all of the July options expire.

For wheat he used July CBOT options and sold 1310 of the 7.80 calls, purchased 1000 of the 7.50 puts, purchased 500 of the 7.30 puts and purchased 550 of the 8.00 calls.

Below is a consolidated view of all of his trades as well as profit projected and present.

A couple things that really stick out are the amount of trades needed or done for corn and wheat versus soybeans. In the beans he has had to trade far less quanity and he is up more.

Keep in mind that futures and options are risky and not suitable for all and past performance doesn't mean similiar future results nothing in this blog is a trading reccomendation.

Wednesday, May 4, 2011

Neutral Nick Update - Is a $20 million dollar profit in the cards?

Nick Update – 5-4-11

It appears Nick is finding out that to keep his program going things keep getting bigger; as in bigger lots trader; bigger reward and thus bigger risk

Once again Neutral Nick did sales only and all July options

Soybeans – Sold 300 of the 13.60 calls, 300 of the 14.00 calls, 200 of the 14.60 calls and 45 of the 13.00 puts

Corn – Sold 500 of the 7.50 calls, 350 of the 8.50 calls, and 40 of the 7.00 puts

Wheat – Sold 400 of the 8.50 calls, 250 of the 8.00 calls, and 50 of the 7.00 puts

Added the potential that if we stay between all of the above strikes $3 million dollars; leverage have to love it and HATE it!

Nick has really found plenty of errors in his plan. Overall he still thinks the concept works; but if his bank pulls the rug under him he goes BROKE and in a hurry.

Please don't try this strategy at home :) Also keep in mind the risk in futures and options as they are not suitable for many.

The biggest thing Nick is really lack is risk management; cash flow and margin requirment are unrealistic in most opinion's and typically if one enters any trade you are better off having a defined risk ahead of jumping on the ride. He really doesn't have any; his concept is simply add to the position and adjust; which if done properly without seeing the money run out and staying close to neutral may be manageable. But what would have happened to him if this corn crop would have turned into the MPLS 2008 wheat type of market? The good thing about options is he may have had a little more flexability then if he was simply short; but his concept would have also had him over leveraged and thus potentially broke.

Bottom line is going forward Nick will really need to fine tune and take what he and myself have learned the past several months and try to have a more defined controlled program going forward if Nick doesn't want to give the farm away.

But for now we will look at where he could be and that simply put more then likely looks good; but usually don't things always look good at the top? What happens to Nick if China really comes and buys up a bunch of old corp corn that isn't there to be bought?

Subscribe to:

Posts (Atom)