Below is a forward from our main Country

Hedging Rep and opening comments.

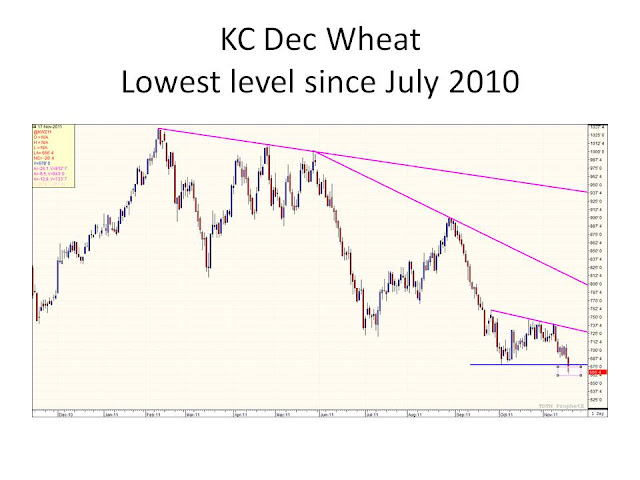

Markets are called mixed this a.m. behind a

USDA report that is overall probably neutral to slightly negative; outside

markets are under extreme pressure and that leaves overall thoughts negative.

In the overnight session we saw corn off a

penny, KC wheat was off 8, MPLS was off 8, CBOT wheat was off 7, and beans

where off about 8 cents. At 9:20 outsides are under pressure with

crude down 2 a barrel, equities very weak with the DOW down 285 points, and the

US Dollar making a new move for the recent high with the Dec up 1.289 at 78.05.

Here is a recap of report

The markets have now opened and been rather

volatile during the 1st hour

or so of trading. We opened under

pressure with the grains lower then most had thought; corn was down about 10-14

on the open, wheat was down 20ish, beans where also twenty or so lower. Now about 11:00 we have seen some massive

improvements. Spring wheat lead the way

higher as it has been up 5-10 cents, and we now have the other wheat contracts

only down 5-10 cents so a good dime off of their lows in both KC and CBOT. Corn has also managed to pull back in

positive territory up about 2-3 cents and beans are off about 8 cents.

Winter wheat basis feels firm and maybe

firmer; I did notice bids today are showing inverses bid for nearby now ahead

of JFM. Spring wheat feels a little

weaker on the basis side of things because of an increase in country selling. Part of the firmness in winter wheat basis

over the past couple of months has been the spread between MPLS and KC; with it

making another leg up firmness in wheat basis shouldn’t go away overnight. BUT today’s carryout numbers are not exactly

bullish for wheat; so when the supply starts moving…………watch for basis to come

under extreme pressure. Keep in mind

buyers are like producers in the sense when things start going their direction

they typically try to pick tops or bottom’s; thus when prices are going up it

is hard to buy grain some days because everyone jumps on the bull camp. The opposite is true when things start going

down; it becomes hard to sell because all of the buyers are afraid it is going

lower.

Don’t forget we are still offering free

delayed price for both spring wheat and winter wheat.

Also this afternoon we will have another

session of our MWC Marketing Hour Round Table.

We invite you to join us.

Thanks

Grain

Merchandiser

Midwest

Cooperatives

800-658-5535

800-658-3670

605-295-3100

(cell)

605-258-2166

(fax)

This communication may contain privileged and/or confidential information

and is intended only for the use of the individual or entity to which it is

addressed. If the reader of this message is not the intended

recipient, you are hereby notified that any unauthorized dissemination,

distribution, and/or use of this communication is strictly

prohibited. This communication makes no representation or warranty

regarding the correctness of any information contained herein, or the

appropriateness of any transaction for any person. Nothing herein shall

be construed as a recommendation to buy or sell any commodity contract.

There is a risk of loss when trading commodity futures or options.

From: Fitch, Joseph

Sent: Wednesday, November 09, 2011 8:24 AM

Subject: Morning Note

Good morning,

We’ll it’s report morning. I’ll cover the details and

try to give some thoughts.

Corn yield down to 146.7 vs 148.1 last month, 1.0 less than

trade guess. Production is down 123 mln bushels. Exports steady,

ethanol steady, therefore feed usage must be falling because ending stocks fall

from 866 mb down to 843 mb, which is only a change of 23 mb. World corn

is 121.57 mmt vs 123.19 mmt last month.

Soybeans – yield 41.3 vs 41.5 last month, .1 lower than

trade guess. Production is down 14 mb. Exports down 50, crush steady,

therefore ending stocks up 35 mb to 195 mb and on its way higher. World

soybeans is 63.56 mmt vs 63.01 mmt last month.

Wheat – SRW, White, and Durum no significant changes.

HRW saw a 30mb reduction in exports and must be some small upward revision to

feed or domestic usage because ending stocks are up 20 mb to 318 mb vs 298 mb

last year. Spring wheat saw a production decline of 7 mb on the resurvey

of the farmer. So production was 398 mb. Exports were raised by 30

mb to 250 mb. This could prove to be on the high end, but raising exports

seemed justified in my analysis. Ending stocks fell by 28 mb to 129 mb so

there is a small reduction in domestic usage. Stocks to use falls to

about 26%.

World wheat was surprisingly close to steady. Ending

stocks grew from 202.37 mmt last month to 202.60 mmt. Kazakhstan was

raised 2 mmt as had been expected. This can be a competitor to spring

wheat some years.

One thing from yesterday is that deliverable stocks of wheat

in Duluth declined from 12.758 mb to 12.389 mb. One year ago stocks were

26.435 mb. This is the wrong time of year to be pulling stocks out.

It makes me nervous because it improves the possibility of the spreads staying

at inverses.

Movement on grains was better yesterday and spring wheat

seemed to be moving at a better clip. Basis could weaken up next week

with the better movement especially if spring wheat tries to head higher on the

balance sheet changes.

Corn has traded up a little in the OTC market. Beans

have 15 cents protection. Wheat is likely mixed with spring wheat likely

higher and winter wheat more dependent on corn for strength. Outside

markets are negative this morning and could influence trade.

Even though the corn yield is still moving tighter, I’m not

sure that the farmer is going to get the very bullish reaction that some seem

to want. I doubt this information without further stress in the grain

markets like a turn for the worse in South America weather or another large

decline in the yield on a future report is going to allow this market to trade

back up to its previous highs. Farmers who are aiming for $7.50 or $8.00

corn are going to be disappointed. I think they need to make realistic

sales going forward and make some sales against production for the next year

and possibly further out. Soybeans continue to look like a sell on the

bounce candidate to me. There isn’t anything bullish there with

production in SA looking like it is going to keep getting bigger and our export

window getting clipped.

Country Hedging, Inc.

The Right Decisions for the Right Reasons

This

communication may contain privileged and/or confidential information and is

intended only for the use of the individual or entity to which it is

addressed. If the reader of this message is not the intended

recipient, you are hereby notified that any unauthorized dissemination,

distribution, and/or use of this communication is strictly

prohibited. Country Hedging, Inc. makes no representation or

warranty regarding the correctness of any information contained herein, or the

appropriateness of any transaction for any person. Nothing herein shall

be construed as a recommendation to buy or sell any commodity contract.