Markets where hammered today as the selling pressure

accelerated as liquidation was seen from the funds; adding to pressure was a

little bit of producer fear selling.

When everything was said and done we saw corn down 28, beans where down

20, KC wheat was off 21, MPLS wheat was down 9, CBOT wheat was off 24, the

stock market was under pressure with the DOW down 135 points, crude off nearly

4.00 a barrel, and the US dollar is firmer.

Also pressure to our markets was the fact that we had just

horrible corn exports we even had a cancellation of some corn that was sold to

unknown (which is typically China). Corn

exports where only 8 million bushels; driving around South Dakota it is pretty

easy to find that and much more on the ground.

Ethanol margins remain very good nearby; but we continue to

miss export business and today that along with outside markets ended up being

too much for our markets to bear. The

fact that we have been range bound for a month or more didn’t help anything

out; as we broke threw some technical levels that seemed to accelerate the

downside as we hit sell stops.

The technical picture has changed a little bit; hopefully it

is just a head fake or a bear trap but technically there now appears to be more

downside risk then upside potential. Fundamentally

we simply lack export to domestic competition and our biggest fundamental is

also moving against us right now. The

funds just don’t seem to have a reason to own anything; with the MF Global

issues and shaky situations in Europe no one has much interest in owning

commodities right now. As long as money

wants to flow out their remains tons of downside risk.

The good thing is that despite the poor exports and poor

demand we are not exactly in an overwhelming or burdensome supply

situation. We have seen supply cut year

over year; so in theory we still should have chances to see a bounce at anytime

should some demand show up or even if we have the outside markets stabilize. Adding to that thought would be the longer

term picture that says we need a lot of corn acres next year; so perhaps that

gives us a chance to sell higher prices sometime in the spring. But proper risk management should be telling

us not to wait that long; especially when we are still at good historical

values. Levels that make good returns; plus what happens to our markets if we

do plant 95 million acres of corn and continue to have more then ample world

supplies.

The price action seen today reminds us of 2008 all

over. With volatility down doing

contracts like min price, min-max or even simply buying some puts to help

protect one from a complete melt down.

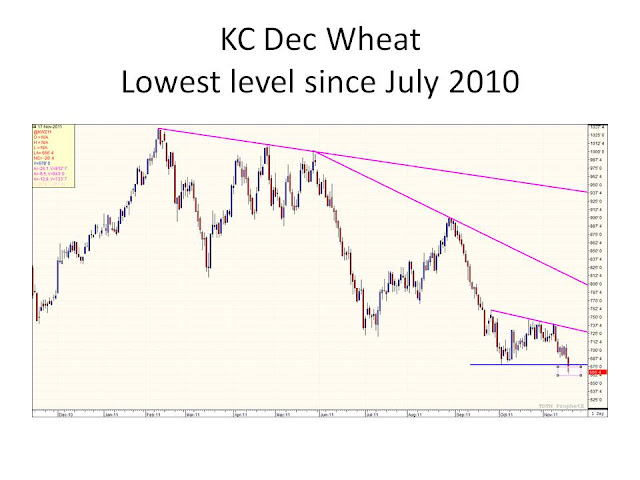

Attached are a couple of charts that show we broke threw

some key support area’s today and really opened up some down side risk.

Please don’t forget we still have free delayed price on both

winter wheat and spring wheat.

No comments:

Post a Comment