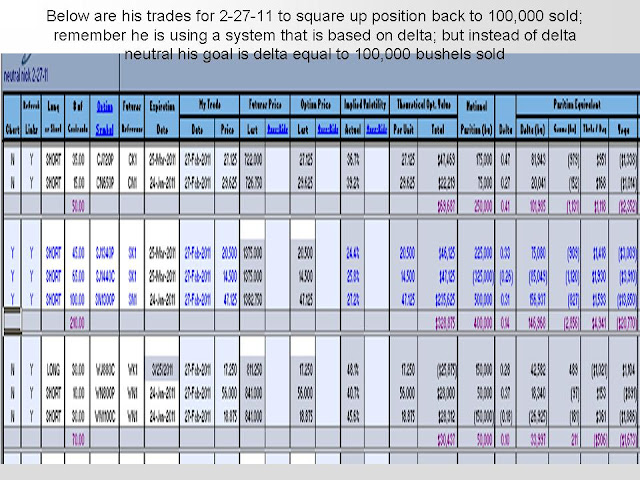

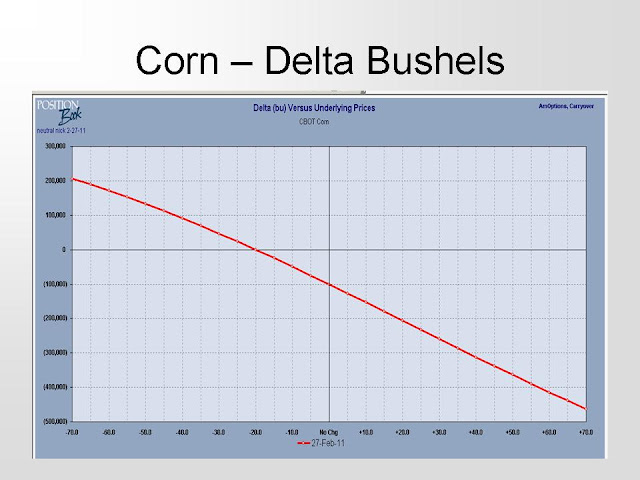

With the very volitale markets our grain marketing character Neutral Nick has been getting whipsawed by the recent price action in the commodities. Last week Nick found himself with a Delta bushel equvialent that was long in a couple grains; this while he had a grain price action target of being equal to having 100,000 bushels of each corn, soybeans, and CBOT wheat sold.

Bottom line is early in the week Nick was

undersold big time (after a huge price drop) and now he finds himself oversold. Perhaps it is to the point where he should just throw in the towel and stick to something more simple.

Almost everybook on anything to do with a type of trading beit stocks, commodities, futures, options, from the dollar index to the euro, to crude oil, corn, wheat, or even gold. Nearly every single one says something about not over trading. As a grain merchansider who helps producer writen and execute grain marketing plans I see it nearly daily where a producer one day feels the prices falling apart and the next the worry is they sold to early.

Finding that balance point between fear and greed seems to be a little harder then one would think as it doesn't seem as easy as sell "yes" or buy "no". Add to that all of the variables that go along with grain price direction and overall how price action works it becomes easy for me to see the stress that can happen in just trying to market ones grain and that is only 1/2 of the overall farming equation (with raising the grain just as if not more difficult).

Back to our character Neutral Nick below are his latest updates. Good or bad. I bet the banker lending him the line of credit for his hedge account isn't sleeping as good now as he was a couple weeks ago.

Bottom line is early in the week Nick was

undersold big time (after a huge price drop) and now he finds himself oversold. Perhaps it is to the point where he should just throw in the towel and stick to something more simple.

Almost everybook on anything to do with a type of trading beit stocks, commodities, futures, options, from the dollar index to the euro, to crude oil, corn, wheat, or even gold. Nearly every single one says something about not over trading. As a grain merchansider who helps producer writen and execute grain marketing plans I see it nearly daily where a producer one day feels the prices falling apart and the next the worry is they sold to early.

Finding that balance point between fear and greed seems to be a little harder then one would think as it doesn't seem as easy as sell "yes" or buy "no". Add to that all of the variables that go along with grain price direction and overall how price action works it becomes easy for me to see the stress that can happen in just trying to market ones grain and that is only 1/2 of the overall farming equation (with raising the grain just as if not more difficult).

Back to our character Neutral Nick below are his latest updates. Good or bad. I bet the banker lending him the line of credit for his hedge account isn't sleeping as good now as he was a couple weeks ago.

No comments:

Post a Comment