Markets had another rather choppy price action ride today as outside markets where stable and a big on going concern remains out there in regards to our potential tightening of our balance sheets.

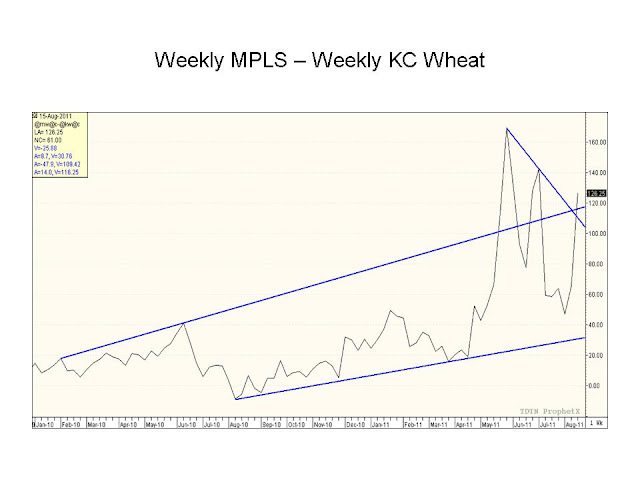

Our bull markets kept going despite the weakness we showed in the overnight session. When all was said and done we seen corn up 5-7 cents, beans where up 10-11 cents, KC wheat was off 7 cents, MPLS wheat was off 6-7 cents, CBOT wheat was down 4-7 cents, the US dollar was firmer, equities showed a slight balance with the DOW up 21 points, and crude was up about 1.50 a barrel.

Goofy price action today in that yesterday we had rather supportive information with the decreased crop conditions but last night we seen weakness in the markets as we did for most of the session; but about mid day things changed around lead by the row crops and we see corn and beans both put in new high closes to end the day. Technically that is great price action and could lead to even more technical buying.

As for new news out there we really seem to be light on the headlines as of late; main focus has been the idea’s that mother nature is taking away yield and yield reduction along with a tight balance sheet gives us bullish fundamentals; at least until we see that projected supply and demand change. Eventually high price are suppose to cure high prices; defining “high prices” remains a challenge and as long as end users can make money buying an end product such as corn the price probably shouldn’t be considered high. Are we near those levels? Perhaps as some industries are challenged and we have seen a lag in the exports; but the latest reports have been good profits for ethanol plants and they are the big dog when it comes to who’s buying our corn.

One negative that has happened lately has been the basis trends for corn and spring wheat; both of those commodities have saw plenty of basis pressure as of late; indicating a lack of end user demand. The spreads between some of the markets and months also have shown bear market signs such as the Sept-Dec corn spread which has went from a big inverse to near full carry as our carry on corn today is very similar to what it was last year despite our balance sheet showing nearly ½ the carryout for old crop as it did last year. That to me doesn’t add up and says there is some risk that we have under stated our 2010-2011 corn crop or overstated our demand? Perhaps we have improved our ethanol effectiveness more then we realize thus we have been grinding less then what we think would be needed to get the type of ethanol production that we have seen reported?

Bottom line is our markets are scary and in more then one way. Potential is out there for prices to continue to see strength because of the supply and demand along with the fact that it seems like the funds want to own grains many days. If we are actually going to run out of corn the price should be the sky; and that is scary because things like basis could really get out of whack. Also scary is the fact that it wouldn’t take much to see some of the mentioned possible negative factors happen thus we see our balance sheets get ugly in a hurry.

Technically we seem to have broken out of some markets; such as Nov beans. But many of our markets still have a sideways technical picture painted on their charts.

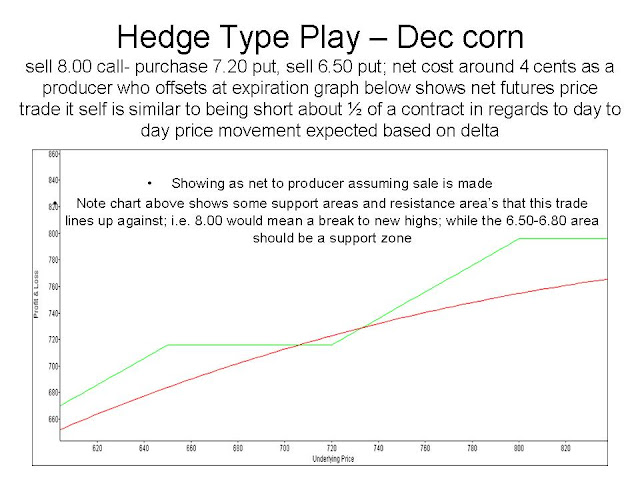

I have attached a few charts.

Please give us a call if there is anything we can do for you.