Grain Markets closed the week very weak behind index fund reallocation, a stronger US dollar, and profit taking. Corn was off 7 cents, beans

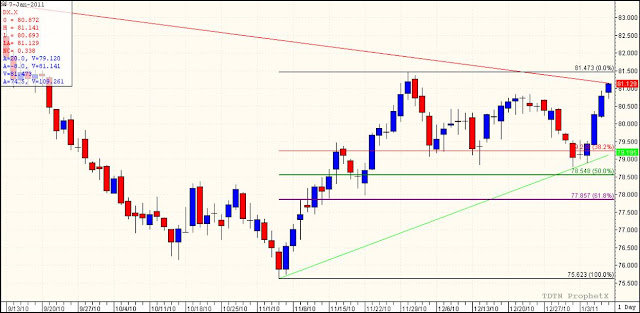

where down 13 cents, KC wheat was down 12 cents, MPLS wheat was off 13, and CBOT wheat was down 14-15. The US dollar was stronger as it showed strength for 4 days in a row now. That little rally happened after the US dollar left a Doji on the charts to start the new year and that happened at trend line support

With the rather volatile price swings we seen this week; I have seen plenty of producers that one day are looking to buy back because it appears we might go higher and then the next day are selling or wanting to sell in fear that it will go lower. Basically another volatile weak in the grain futures markets that left more questions then answers.

Technically I mentioned the US dollar above and that could be one of the more concerning items when one looks towards the future of the grains. The price action when seen this week was the dollar hold support near the 50% retracement and also support near the trend line.

With the volatile price action we have seen this week it has caused our marketing character Neutral Nick to have to make additional trades. When I looked at what adustments needed to be made to keep him near 100,000 bushels sold; i first thought to see if there was anyting great that locked in a profit. I really didn't see any trades where we where up more then a dime and generically speaking I don't want to lock in profits that end up paying more in commission then actual profits. So as a general rule Nick doesn't sell options unless he can get 10 cents or more and usually won't try to take profits for under a dime.

To keep him near 100,000 bushels of each wheat, corn, and beans sold Nick added the following which add to the hedge statement making it even more complicated. He sold 3 730 CBOT MARCH WHEAT Calls for 68 cents a piece.

With the March Wheat futures trading at 7.74 he figures this play is similar to adding 22 cents (7.30+.68-7.74) cents to his wheat price versus just a straight sale;or receiving 7.98 (if we expire above 7.30) his big risk is that we expire below 7.30 and which case he no longer has sales on.

For beans he added 4 short 13.00 March Soybean calls for 93 cents a piece. Once again very similar to wheat in that this is a re-ownerhsip strategy via selling an in the money covered call.

For corn he switched things up a little bit as he sold 5 of the 6.60 March corn calls, sold 2 of the July 5.00 corn puts, and bought 5 of the February (Serial Option), 6.00 calls.

When looking at his performance for the past couple of weeks Nick leaves today a little dissappointed; as the last time he looked his July 10.00 Wheat calls that he sold where worth about 46 cents and the board was about a quarter higher. Yet today those calls are still worth about 46 cents even tough the board is a quarter or so cheaper. I guess that just helps show what swings in volatility can do to option prices.

Another thing that he has noted is that even though he has a net delta position that is show about 100,000 bushels his wheat options lost value around despite the board showing weakness the past couple of sessions at a time when he was short.

Next week we have the USDA report out so Neutral Nick is trying to think and watch out for market traps. When he thinks of marketing traps or mistakes in trading/marketing one thing that comes to mind is leverage and the potential for over leverage on the wrong side of the market. So with the report out the one thing Nick won't be doing is adding short option positions that expire rather soon because the closer they are to the money and as time erodes those options have the potential to see their gamma and delta move rather fast.

So the only really short term options Nick will work with heading into the USDA report will be those on the long side; whether it is a put to protect or a call to re-own.

Below is Nick's updated position

Information about grain markets and info to help producers to market crops. See how various grain marketing strategies can effect ones average price. We will be posting various potential trade and option strategies along with marketing decisions made on our mock farms. Now helping daily market minute in empowering farmers to fight big ag and become price makers. Education to help farmers manage crop risk such as corn, soybean, and wheat prices. Using futures, options, basis contracts etc.

Friday, January 7, 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment