Below are some potential trade thoughts ahead of the USDA report

Some of these are trade thoughts that are for protecting ahead of the USDA Report; some are strictly spec moves, and some act as cross hedges.

This first trade is a

note if not mentioned ideas are typically based on experation

Based on Monday's close a protection hedge type of a play would be to

•Purchase 6.20 July put; sell 5.30 July put and sell 7.20 July call

Acts as 90 cents possible protection at the money in exchange have upside open a dollar

•

•

•

at experation one is short at 7.20 if we are above; nothing done 6.20-7.20; and short at 6.20 if we are below; up until 5.30 at which point position washes out but leaves you with 90 cents hedge or protection gains

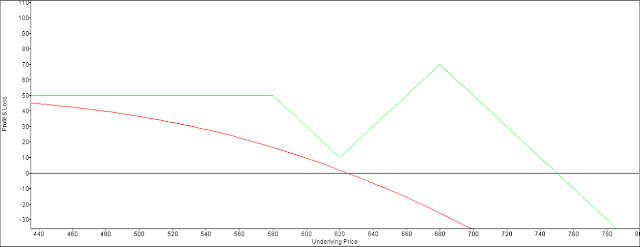

Here is P L Graph of trade by self

benefit is that the three legs give you potential to leg out and open up play; protection is at present level while upside has a little room to let the market rally

negative - doesn't give 100% protection; now or in future as has protection capped; and also won't move penny for penny with market.........three legs equals more cost then 1 straight trade

*************

Three leg trade - Protection plus upside premium------

Sell 1 July 5.80 call

Purchase 2 July 6.20 calls

Sell 2 July 6.80 calls

Collect aprox 50 cents; which is max protection that starts at 6.20; so as a producer one nets (at experation and on board i.e. not calulating basis, and assuming sale made to finish off hedge at correct time) $6.30.......as one does at all levels 6.30-5.80; but below 5.80 the max protection is 50 cents.........so at 5.00 as example one only nets 5.50 or about 70 cents less then simply selling today

on the upside one owns an additional contract at 6.20 up to 6.80; (this play is designed to hedge 5,000 bushels at experation; depending on what level that is determines if one needs to place additonal trade to make cash sale or if the play's legs take care of themself) So basis 5k bushels one receives penny for penny premium on corn from 6.20 to 6.80..........at that point one becomes capped; but his cap isn;t until 7.50 and he hits the cap or max 70 cents earlier

below is P L Graph of trade

Keep in mind that most things that sound too good to be true are; so draw back from this trade is the fact that one is short 3 calls and only long 2; if we go past the level of where the last short call is sold the trade then at experation acts no different then a short call when it hits it's strike; other then you got paid a little to place it

If one has corn; then this can act like a covered call; which the goal is usually that covered calls see the futures go to where the stikes are sold and then one simply sells because that was orginal goal and we have rallied in order to get there

Genericaly as a spec trade the above risk/reward profile doesn't ook that bad; as the trade doesn;t lose untill or if we get towards the high

Re-Ownership

Sell 5.50 July Put; purchase 2 6.00-6.50 bull call spreads

If unchanged from today's close; it returns about 40 cents, not forced to own until a 70 cent break at experation

Best benefit is on a 30 cent rally it returns about 1.00 a bushel

Drawback will be exiting as until we get close to experation or see that markets move dramatically it will be hard to get anywhere close to experation possiblites

Sell 5.50 July Put; purchase 2 6.00-6.50 bull call spreads

If unchanged from today's close; it returns about 40 cents, not forced to own until a 70 cent break at experation

Best benefit is on a 30 cent rally it returns about 1.00 a bushel

Drawback will be exiting as until we get close to experation or see that markets move dramatically it will be hard to get anywhere close to experation possiblites

Below are trades done based on Friday's close

Protection - 3 Leg

Buy at the money bear put spread and sell OTM call; prefer same month for market exposure if done as a hedge.

*******************************

Generic thoughts

Volatilty is high so buying options whether as protection or re-ownership has a chance to work; but most trades will be tough; so it might make sense to lock at sellling some to help cheapen cost and turn the odds a little in ones favor

Watch out for selling too many options; because leverage can kill one when the market throughs us for loops as it usually trys to do

Typical protection play is buy a put and re-ownerhsip is buy a call; but other things can be considered when looking at more advanced hedge strategies. Such as selling a put at a level you would want to support or buy a commodity at; selling a call against grain that one owns, or the combination as well as otther compinations that potentiall add even more legs

I didn't discuss simply strategy of selling cash grain and selling put against as re-ownership level.

*******************************

Generic thoughts

Volatilty is high so buying options whether as protection or re-ownership has a chance to work; but most trades will be tough; so it might make sense to lock at sellling some to help cheapen cost and turn the odds a little in ones favor

Watch out for selling too many options; because leverage can kill one when the market throughs us for loops as it usually trys to do

Typical protection play is buy a put and re-ownerhsip is buy a call; but other things can be considered when looking at more advanced hedge strategies. Such as selling a put at a level you would want to support or buy a commodity at; selling a call against grain that one owns, or the combination as well as otther compinations that potentiall add even more legs

I didn't discuss simply strategy of selling cash grain and selling put against as re-ownership level.

As always these are not reccomendations, past results don't equal future results, and there is risk in trading futures and options.

Calendar –Neutral Big Move

Both sides- big move expected

Buy 5.90 Feb put; buy 6.10 Feb Call

Sell March 5.50 Put, sell March 6.50 call

Short term options will move faster with a higher delta and higher gamma

Below is projection 11 days from now or 1 day before expiration. Will need to pull off then or have plenty of risk

(This was a projection before the close open on Sunday night)

if move is big trade will or should work.........but if move is small trade will not work very well..........

red line is projected 11 days from now and green line.........would be when both the feb- and march options expire.......

Calendar Bullish

purchase 6.10 Feb call sell 6.60 march call –below is position book with overrides for 11 days from now; when Feb options expire 6.00 loss dime….need to buy back short March or unlimited risk opened up; same for all below;

6.00 out about a dime

6.20 out about 6-7 cents

6.50 up about 10 cents

7.00 up about 30 cents

5.80 out about 7 cents

5.50 out about 3 cents

Multiple Nearby OTM –paid for via deferred sold OTM calls and puts

Purchase 10 Feb 6.40 calls and sell 1 5.50 July Put and 1 7.00 July callAt 7.00 March futures; when Feb options expire trade makes about $30,000could buy ½ puts and ½ calls if expected a big move or could buy call spreads instead of the OTM call as

Purchase 10 Feb 6.40 calls and sell 1 5.50 July Put and 1 7.00 July callAt 7.00 March futures; when Feb options expire trade makes about $30,000could buy ½ puts and ½ calls if expected a big move or could buy call spreads instead of the OTM call as

in sense this is offering out July corn above the market or wililng to re-own July corn below the market; in exchange if corn moves very firm in the next week; this will act like owning 9 contracts for the short term. (VERY SHORT TERM)

No comments:

Post a Comment